Question: You will keep the bakery open for 8 year. To start up, you have to invest $180,000 for your fixed assets. Revenue in first

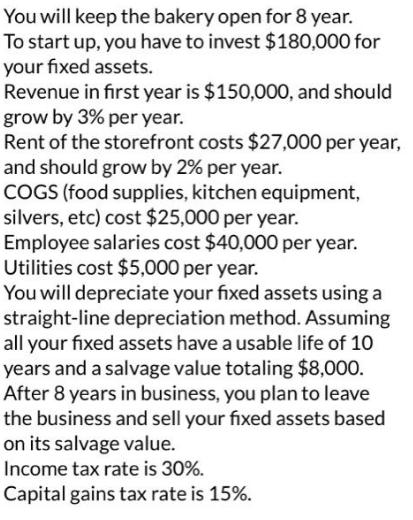

You will keep the bakery open for 8 year. To start up, you have to invest $180,000 for your fixed assets. Revenue in first year is $150,000, and should grow by 3% per year. Rent of the storefront costs $27,000 per year, and should grow by 2% per year. COGS (food supplies, kitchen equipment, silvers, etc) cost $25,000 per year. Employee salaries cost $40,000 per year. Utilities cost $5,000 per year. You will depreciate your fixed assets using a straight-line depreciation method. Assuming all your fixed assets have a usable life of 10 years and a salvage value totaling $8,000. After 8 years in business, you plan to leave the business and sell your fixed assets based on its salvage value. Income tax rate is 30%. Capital gains tax rate is 15%. If you require at least 10% return, what's NPV and IRR of this investment?

Step by Step Solution

3.47 Rating (154 Votes )

There are 3 Steps involved in it

The net present value NPV and internal rate of return IRR of this investment can be calculated using ... View full answer

Get step-by-step solutions from verified subject matter experts