Question: You will need a statistical package for computing PCA (SVD) of matrices and an optimizer (like Solver in Excel). 4. Consider the stocks AAPL, TSLA,

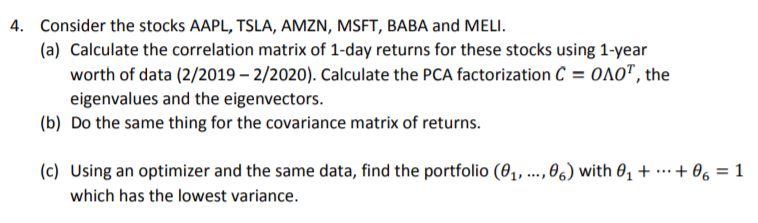

You will need a statistical package for computing PCA (SVD) of matrices and an optimizer (like Solver in Excel). 4. Consider the stocks AAPL, TSLA, AMZN, MSFT, BABA and MELI. (a) Calculate the correlation matrix of 1-day returns for these stocks using 1-year worth of data (2/2019 - 2/2020). Calculate the PCA factorization C = 010", the eigenvalues and the eigenvectors. (b) Do the same thing for the covariance matrix of returns. (c) Using an optimizer and the same data, find the portfolio (1,...,0%) with @ + ... + 6 = 1 which has the lowest variance. You will need a statistical package for computing PCA (SVD) of matrices and an optimizer (like Solver in Excel). 4. Consider the stocks AAPL, TSLA, AMZN, MSFT, BABA and MELI. (a) Calculate the correlation matrix of 1-day returns for these stocks using 1-year worth of data (2/2019 - 2/2020). Calculate the PCA factorization C = 010", the eigenvalues and the eigenvectors. (b) Do the same thing for the covariance matrix of returns. (c) Using an optimizer and the same data, find the portfolio (1,...,0%) with @ + ... + 6 = 1 which has the lowest variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts