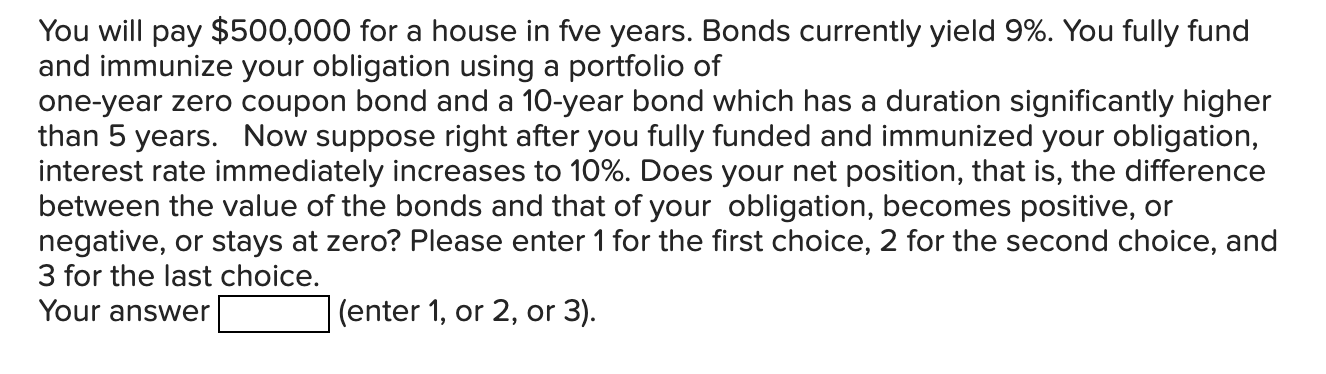

Question: You will pay $ 5 0 0 , 0 0 0 for a house in fve years. Bonds currently yield 9 % . You fully

You will pay $ for a house in fve years. Bonds currently yield You fully fund

and immunize your obligation using a portfolio of

oneyear zero coupon bond and a year bond which has a duration significantly higher

than years. Now suppose right after you fully funded and immunized your obligation,

interest rate immediately increases to Does your net position, that is the difference

between the value of the bonds and that of your obligation, becomes positive, or

negative, or stays at zero? Please enter for the first choice, for the second choice, and

for the last choice.

Your answer

enter or or

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock