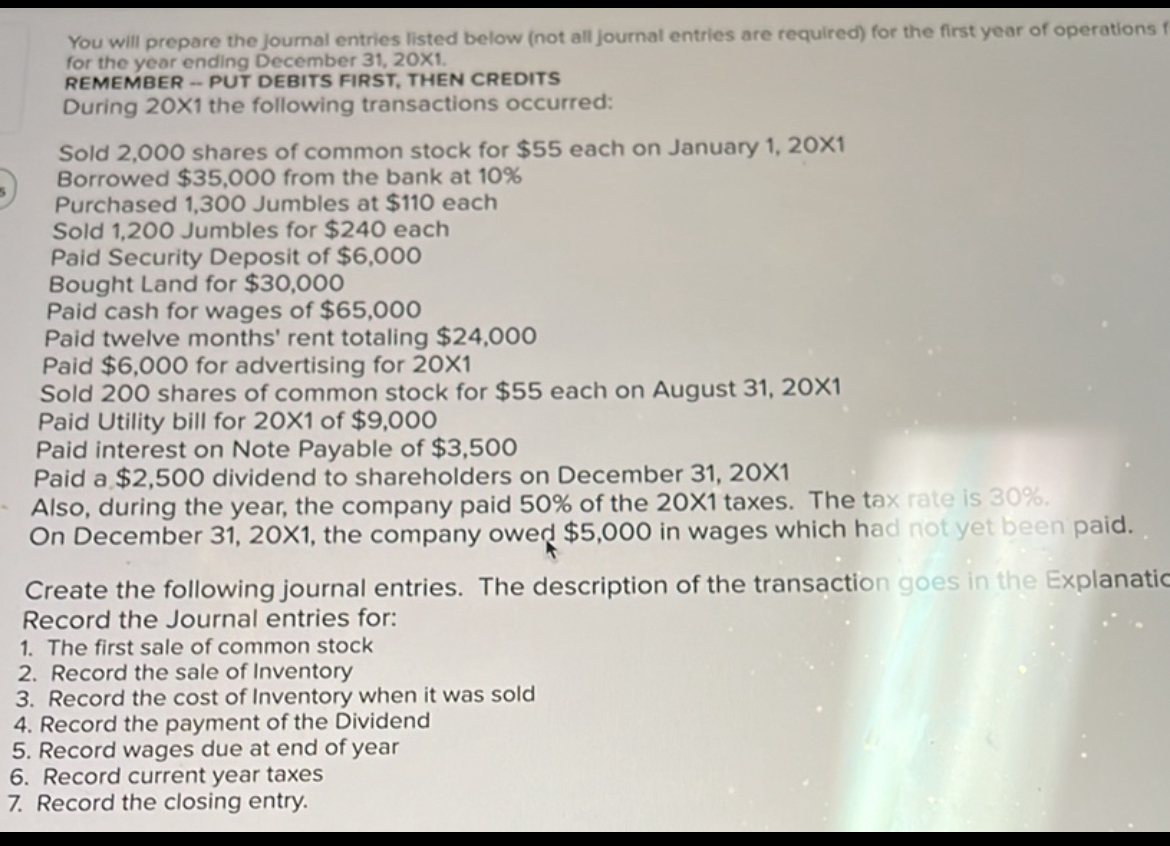

Question: You will prepare the journal entries listed below ( not all journal entries are required ) for the first year of operations for the year

You will prepare the journal entries listed below not all journal entries are required for the first year of operations

for the year ending December X

REMEMBER PUT DEBITS FIRST, THEN CREDITS

During the following transactions occurred:

Sold shares of common stock for $ each on January X

Borrowed $ from the bank at

Purchased Jumbles at $ each

Sold Jumbles for $ each

Paid Security Deposit of $

Bought Land for $

Paid cash for wages of $

Paid twelve months' rent totaling $

Paid $ for advertising for X

Sold shares of common stock for $ each on August X

Paid Utility bill for X of $

Paid interest on Note Payable of $

Paid a $ dividend to shareholders on December X

Also, during the year, the company paid of the taxes. The tax rate is

On December times the company owed $ in wages which had not yet been paid.

Create the following journal entries. The description of the transaction goes in the Explanatic

Record the Journal entries for:

The first sale of common stock

Record the sale of Inventory

Record the cost of Inventory when it was sold

Record the payment of the Dividend

Record wages due at end of year

Record current year taxes

Record the closing entry.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock