Question: You work as an analyst at Medium Term Capital Management (MTCM) in the U.S. equities long-short fund. Your job is to recommend investments for the

You work as an analyst at Medium Term Capital Management (MTCM) in the U.S. equities long-short fund. Your job is to recommend investments for the fund to make based on a combination of fundamental and technical analysis.

You have heard about PlayPause, the game store company, from the popular influencer Howling Puppy. You don't usually take stock recommendations from TikTok influencers, but Howling Puppy seems to be making money?! He must know something you don't.

You want to be sure of the investment before recommending to the fund manager to invest $15 million into the stock. Step one is to analyze whether or not the firm is liquid or if it is heading for a major downturn. You have pieced together copies of the financial statements from historic 10-K filings. Rather frustratingly, the company has changed the way it reports, so the financial statements are not consistent. You will need to use the data provided in the financial statements to calculate the missing elements.

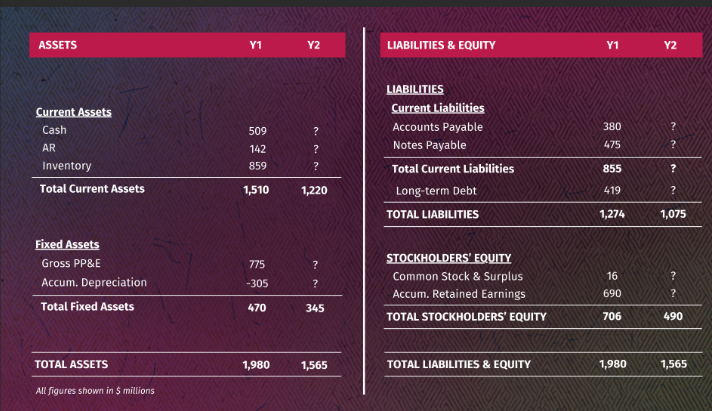

Figure 1: The partially completed Balance Sheet of PlayPause.

The balance sheet, income statement, and statement of cash flows are attached for download.

Your task is to:

Calculate the missing items in the Balance Sheet (Y2). Note, you will need to use the Income Statement and Statement of Cash Flows to complete the Balance Sheet. You will find them attached as "PlayPause Financial Statements."

Hint:Think about how the statement of cash flows explains changes in the balance sheet from Year 1 to Year 2 and whether each item is a source of cash or a use of cash.

Analyze the financial statements and calculate the debt ratios to determine the company's solvency and liquidity.

Answer the questions below. To answer the questions, choose from the 10 available answer options that are closest to the correct answer. Once you have chosen your answers, take note and submit them in the following page called "Submit Your Answers Here".

Q1: Which amount is closest to the Current Ratio?

(a) 0.5, (b) 0.6, (c) 0.7, (d) 0.8, (e) 0.9, (f) 1.0, (g) 1.1, (h) 1.2, (i) 1.3, (j) 1.4

Q2: Which amount is closest to the Quick Ratio?

(a) 0.5, (b) 0.6, (c) 0.7, (d) 0.8, (e) 0.9, (f) 1.0, (g) 1.1, (h) 1.2, (i) 1.3, (j) 1.4

Q3: Which amount is closest to the Cash Ratio?

(a) 0.5, (b) 0.6, (c) 0.7, (d) 0.8, (e) 0.9, (f) 1.0, (g) 1.1, (h) 1.2, (i) 1.3, (j) 1.4

Q4: Which amount is closest to the Debt-to-Asset Ratio?

(a) 0.5, (b) 0.6, (c) 0.7, (d) 0.8, (e) 0.9, (f) 1.0, (g) 1.1, (h) 1.2, (i) 1.3, (j) 1.4

Q5: Which amount is the closest to the Net Working Capital to Total Assets Ratio?

(a) 0, (b) 0.1, (c) 0.2, (d) 0.3, (e) 0.4, (f) 0.5, (g) 0.6, (h) 0.7, (i) 0.8, (j) 0.9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts