Question: You work as an analyst for an MNC that has many subsidiaries around the world. Your company is concerned that the Chinese Yuan (CNY) will

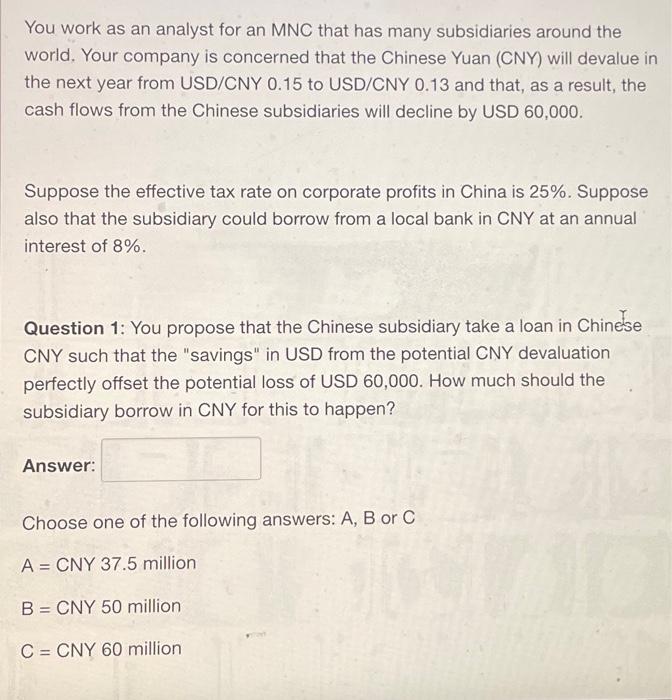

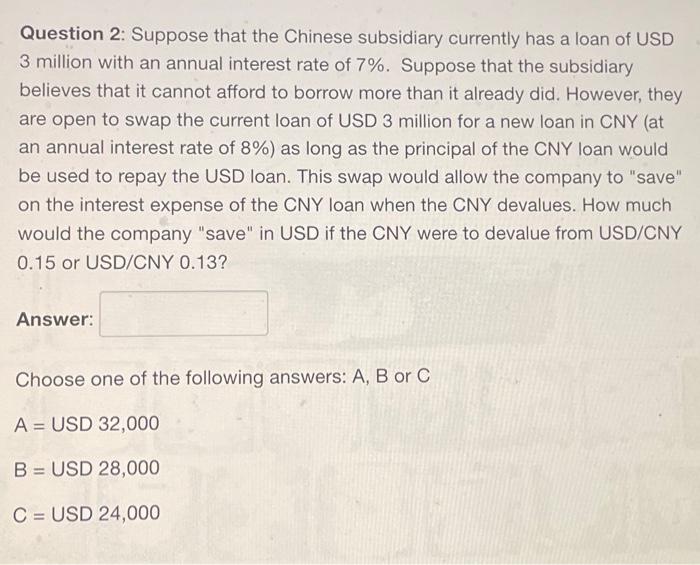

You work as an analyst for an MNC that has many subsidiaries around the world. Your company is concerned that the Chinese Yuan (CNY) will devalue in the next year from USD/CNY 0.15 to USD/CNY 0.13 and that, as a result, the cash flows from the Chinese subsidiaries will decline by USD 60,000 . Suppose the effective tax rate on corporate profits in China is 25%. Suppose also that the subsidiary could borrow from a local bank in CNY at an annual interest of 8%. Question 1: You propose that the Chinese subsidiary take a loan in Chinese CNY such that the "savings" in USD from the potential CNY devaluation perfectly offset the potential loss of USD 60,000. How much should the subsidiary borrow in CNY for this to happen? Answer: Choose one of the following answers: A, B or C A=CNY37.5 million B= CNY 50 million C=CNY60 million Question 2: Suppose that the Chinese subsidiary currently has a loan of USD 3 million with an annual interest rate of 7%. Suppose that the subsidiary believes that it cannot afford to borrow more than it already did. However, they are open to swap the current loan of USD 3 million for a new loan in CNY (at an annual interest rate of 8% ) as long as the principal of the CNY loan would be used to repay the USD loan. This swap would allow the company to "save" on the interest expense of the CNY loan when the CNY devalues. How much would the company "save" in USD if the CNY were to devalue from USD/CNY 0.15 or USD/CNY 0.13 ? Answer: Choose one of the following answers: A, B or C A=USD32,000B=USD28,000C=USD24,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts