Question: You work as an analyst for the CFO for a smaller exchange traded company. The CFO says we are getting ready to do a new

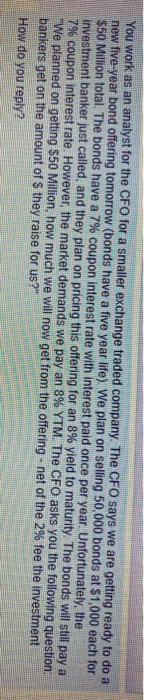

You work as an analyst for the CFO for a smaller exchange traded company. The CFO says we are getting ready to do a new five-year bond offering tomorrow (bonds have a five year life). We plan on selling 50,000 bonds at $1,000 each for $50 Million total. The bonds have a 7% coupon interest rate with interest paid once per year. Unfortunately, the investment banker just called, and they plan on pricing this offering for an 8% yield to maturity. The bonds will still pay a 7% coupon interest rate. However, the market demands we pay an 8% YTM. The CFO asks you the following question: "We planned on getting $50 Million, how much we will now get from the offering - net of the 2% ee the investment bankers get on the amount of S they raise for us?" How do you reply

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts