Question: You work for a consumer - packaged goods ( CPG ) company that sells $ 6 5 0 million of a particular product. The company

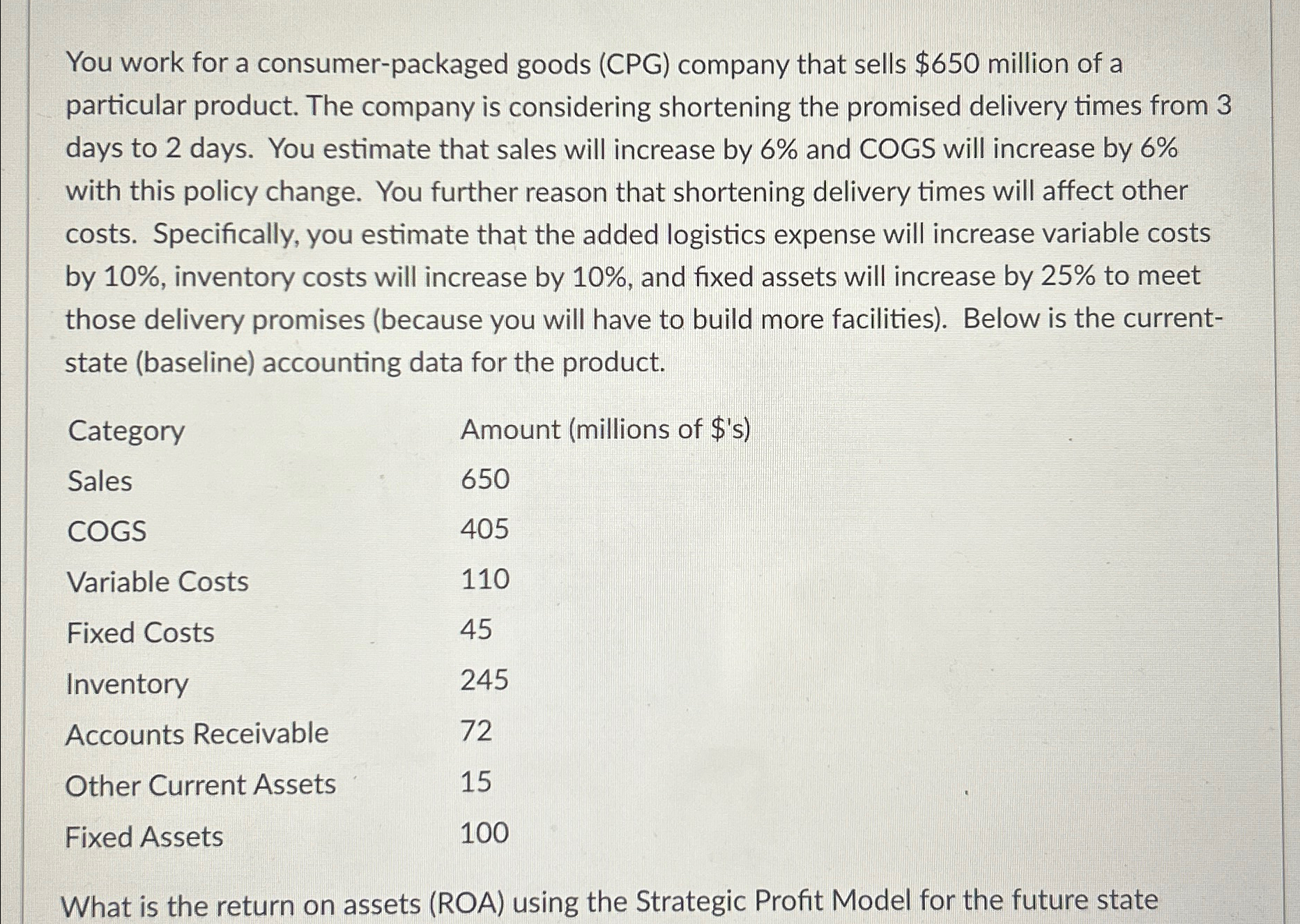

You work for a consumerpackaged goods CPG company that sells $ million of a particular product. The company is considering shortening the promised delivery times from days to days. You estimate that sales will increase by and COGS will increase by with this policy change. You further reason that shortening delivery times will affect other costs. Specifically, you estimate that the added logistics expense will increase variable costs by inventory costs will increase by and fixed assets will increase by to meet those delivery promises because you will have to build more facilities Below is the currentstate baseline accounting data for the product.

tableCategoryAmount millions of $sSalesCOGSVariable Costs,Fixed Costs,InventoryAccounts Receivable,Other Current Assets,Fixed Assets,

What is the return on assets ROA using the Strategic Profit Model for the future state

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock