Question: You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a very common practice with expensive, high-tech equipment). The

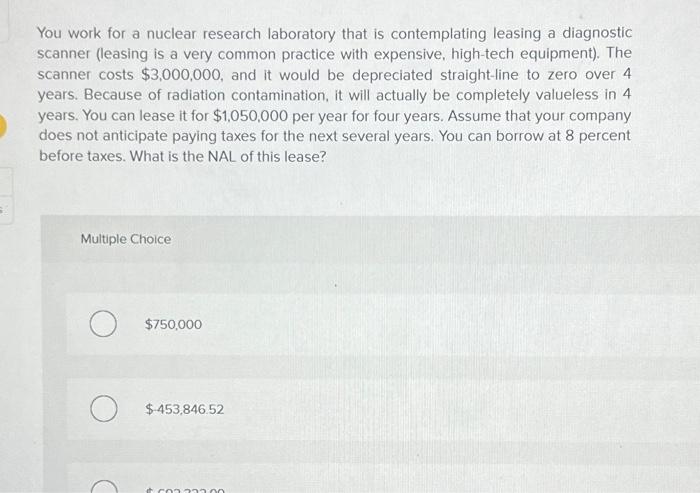

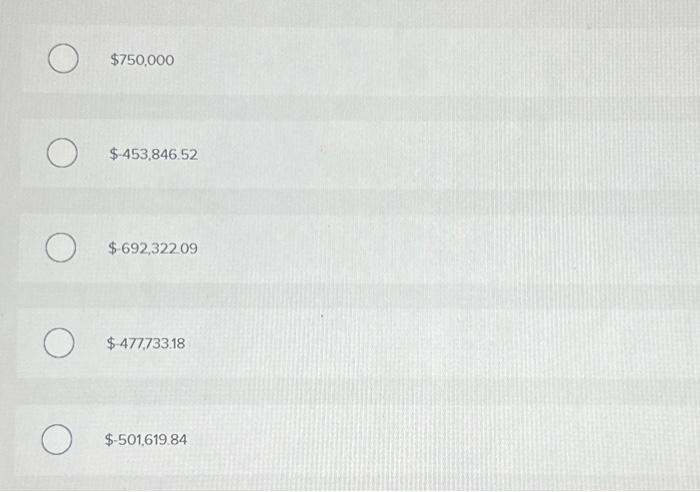

You work for a nuclear research laboratory that is contemplating leasing a diagnostic scanner (leasing is a very common practice with expensive, high-tech equipment). The scanner costs $3,000,000, and it would be depreciated straight-line to zero over 4 years. Because of radiation contamination, it will actually be completely valueless in 4 years. You can lease it for $1,050,000 per year for four years. Assume that your company does not anticipate paying taxes for the next several years. You can borrow at 8 percent before taxes. What is the NAL of this lease? Multiple Choice $750,000 $453,846.52 $750,000 $.453,846.52 $692,32209 $477.733.18 \$-501.619.84

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts