Question: You work for a resource company that is evaluating the option of investing in a new project to improve the recovery of copper in a

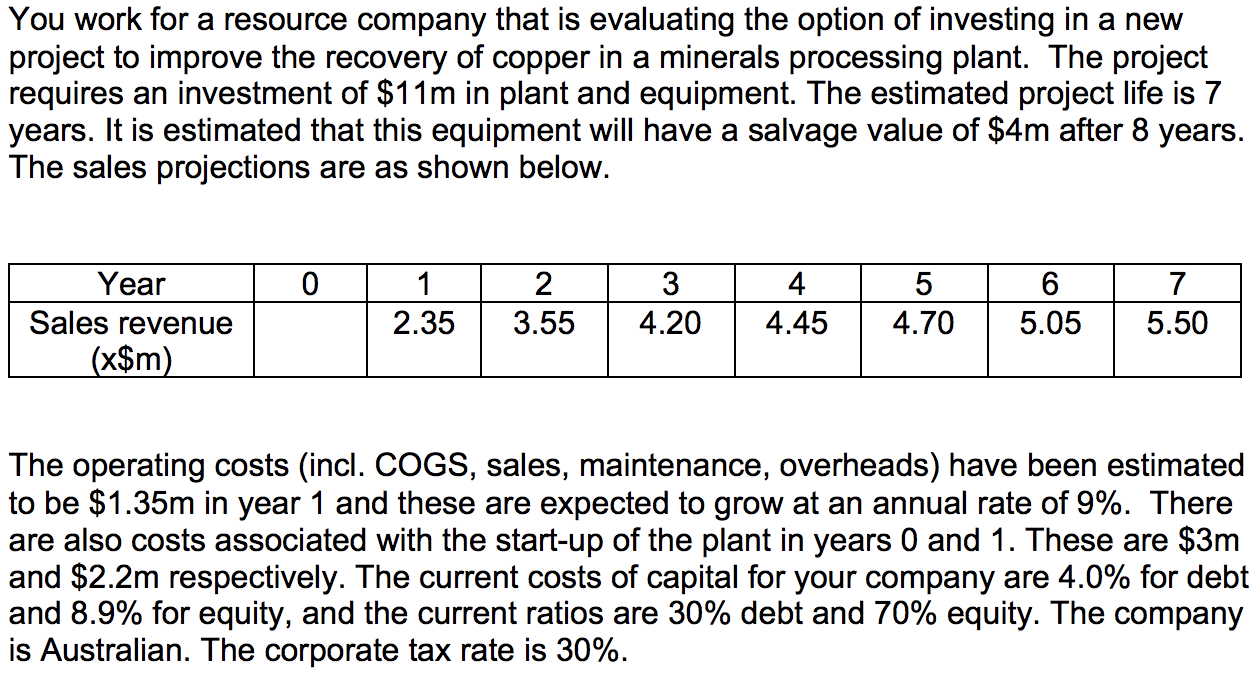

You work for a resource company that is evaluating the option of investing in a new project to improve the recovery of copper in a minerals processing plant. The project requires an investment of $11m in plant and equipment. The estimated project life is 7 years. It is estimated that this equipment will have a salvage value of $4m after 8 years. The sales projections are as shown below. 0 Year Sales revenue (x$m) 1 2.35 2 3.55 3 4.20 4 4.45 5 4.70 6 5.05 7 5.50 The operating costs (incl. COGS, sales, maintenance, overheads) have been estimated to be $1.35m in year 1 and these are expected to grow at an annual rate of 9%. There are also costs associated with the start-up of the plant in years 0 and 1. These are $3m and $2.2m respectively. The current costs of capital for your company are 4.0% for debt and 8.9% for equity, and the current ratios are 30% debt and 70% equity. The company is Australian. The corporate tax rate is 30%. e) With the current debt, your company will incur annual interest costs. Should these interest costs be included in the project DCF analysis? If so, how does this affect the assessment of the project viability? You work for a resource company that is evaluating the option of investing in a new project to improve the recovery of copper in a minerals processing plant. The project requires an investment of $11m in plant and equipment. The estimated project life is 7 years. It is estimated that this equipment will have a salvage value of $4m after 8 years. The sales projections are as shown below. 0 Year Sales revenue (x$m) 1 2.35 2 3.55 3 4.20 4 4.45 5 4.70 6 5.05 7 5.50 The operating costs (incl. COGS, sales, maintenance, overheads) have been estimated to be $1.35m in year 1 and these are expected to grow at an annual rate of 9%. There are also costs associated with the start-up of the plant in years 0 and 1. These are $3m and $2.2m respectively. The current costs of capital for your company are 4.0% for debt and 8.9% for equity, and the current ratios are 30% debt and 70% equity. The company is Australian. The corporate tax rate is 30%. e) With the current debt, your company will incur annual interest costs. Should these interest costs be included in the project DCF analysis? If so, how does this affect the assessment of the project viability

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts