Question: You work for a U.S.-based firm that is considering a project in which it has an initial outlay of $5 million (USD) and expects to

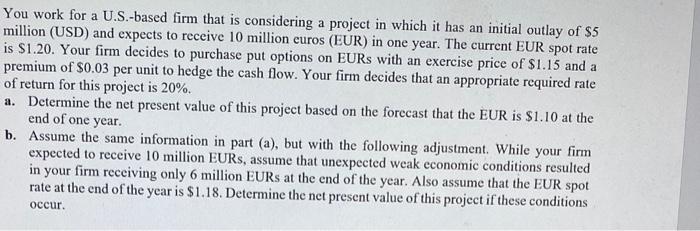

You work for a U.S.-based firm that is considering a project in which it has an initial outlay of $5 million (USD) and expects to receive 10 million euros (EUR) in one year. The current EUR spot rate is $1.20. Your firm decides to purchase put options on EURs with an exercise price of $1.15 and a premium of $0.03 per unit to hedge the cash flow. Your firm decides that an appropriate required rate of return for this project is 20%. a. Determine the net present value of this project based on the forecast that the EUR is $1.10 at the end of one year. b. Assume the same information in part (a), but with the following adjustment. While your firm expected to receive 10 million EURs, assume that unexpected weak economic conditions resulted in your firm receiving only 6 million EURs at the end of the year. Also assume that the EUR spot rate at the end of the year is $1.18. Determine the net present value of this project if these conditions occur

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts