Question: You work on an internal data science team at an online bank, iBank. One recent change in the loan business is that transactional data is

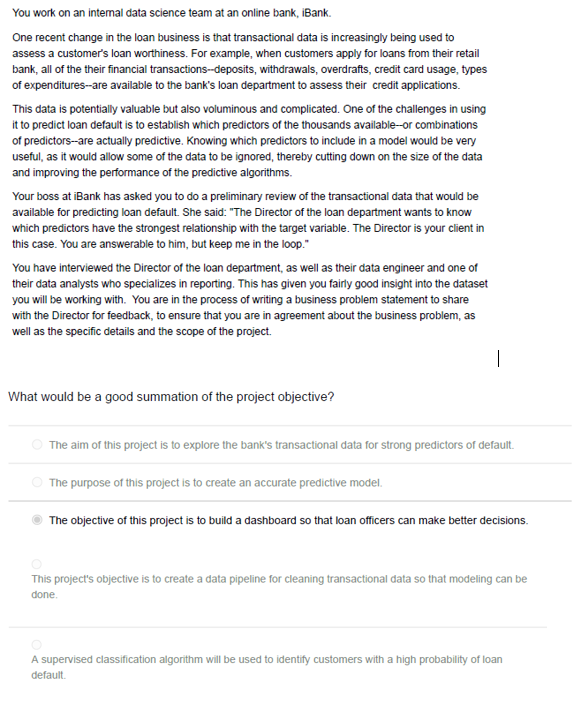

You work on an internal data science team at an online bank, iBank. One recent change in the loan business is that transactional data is increasingly being used to assess a customer's loan worthiness. For example, when customers apply for loans from their retail bank, all of the their financial transactions--deposits, withdrawals, overdrafts, credit card usage, types of expenditures--are available to the bank's loan department to assess their credit applications. This data is potentially valuable but also voluminous and complicated. One of the challenges in using it to predict loan default is to establish which predictors of the thousands available-or combinations of predictors--are actually predictive. Knowing which predictors to include in a model would be very useful, as it would allow some of the data to be ignored, thereby cutting down on the size of the data and improving the performance of the predictive algorithms. Your boss at iBank has asked you to do a preliminary review of the transactional data that would be available for predicting loan default She said: "The Director of the loan department wants to know which predictors have the strongest relationship with the target variable. The Director is your client in this case. You are answerable to him, but keep me in the loop." You have interviewed the Director of the loan department, as well as their data engineer and one of their data analysts who specializes in reporting. This has given you fairly good insight into the dataset you will be working with. You are in the process of writing a business problem statement to share with the Director for feedback, to ensure that you are in agreement about the business problem, as well as the specific details and the scope of the project. 1 What would be a good summation of the project objective? The aim of this project is to explore the bank's transactional data for strong predictors of default. The purpose of this project is to create an accurate predictive model. The objective of this project is to build a dashboard so that loan officers can make better decisions. This project's objective is to create a data pipeline for cleaning transactional data so that modeling can be done. A supervised classification algorithm will be used to identify customers with a high probability of loan default

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts