Question: You working as a fund manager and trying to value the stock of ALI Berhad, Company has 10 million shares outstanding. All the answer must

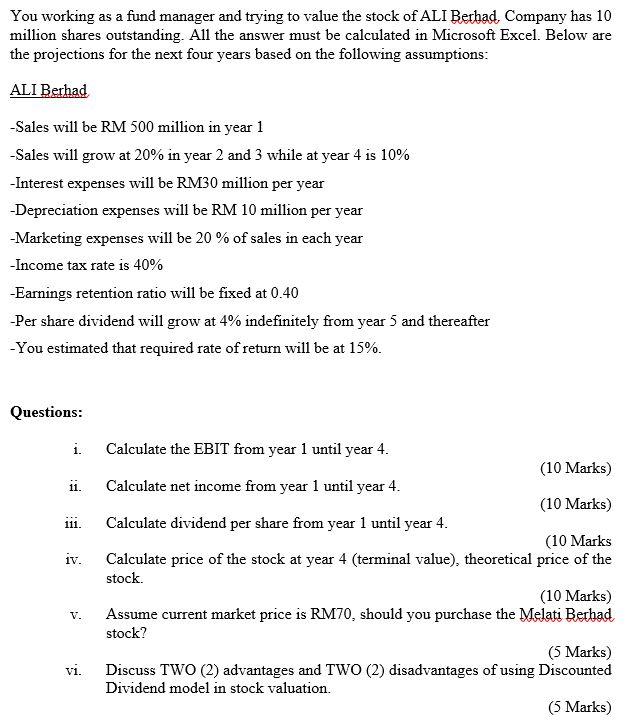

You working as a fund manager and trying to value the stock of ALI Berhad, Company has 10 million shares outstanding. All the answer must be calculated in Microsoft Excel. Below are the projections for the next four years based on the following assumptions: ALI Berhad -Sales will be RM 500 million in year 1 -Sales will grow at 20% in year 2 and 3 while at year 4 is 10% -Interest expenses will be RM30 million per year -Depreciation expenses will be RM 10 million per year -Marketing expenses will be 20% of sales in each year -Income tax rate is 40% -Earnings retention ratio will be fixed at 0.40 -Per share dividend will grow at 4% indefinitely from year 5 and thereafter -You estimated that required rate of return will be at 15%. Questions: i. ii. 111. iv. Calculate the EBIT from year 1 until year 4. (10 Marks) Calculate net income from year 1 until year 4. (10 Marks) Calculate dividend per share from year 1 until year 4. (10 Marks Calculate price of the stock at year 4 (terminal value), theoretical price of the stock. (10 Marks) Assume current market price is RM70, should you purchase the Melati Berhad stock? (5 Marks) Discuss TWO (2) advantages and TWO (2) disadvantages of using Discounted Dividend model in stock valuation. (5 Marks) V. vi

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts