Question: You would like to construct a position that will have a constant ceiling on the total profit if stock price goes down and a

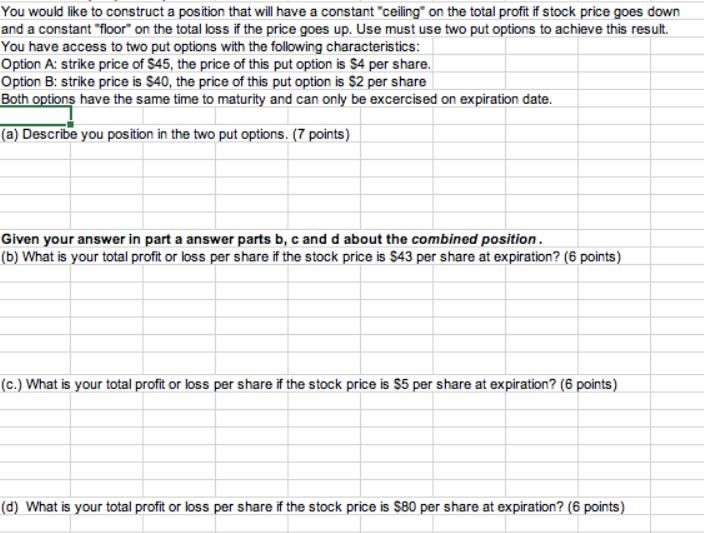

You would like to construct a position that will have a constant "ceiling" on the total profit if stock price goes down and a constant "floor" on the total loss if the price goes up. Use must use two put options to achieve this result. You have access to two put options with the following characteristics: Option A: strike price of $45, the price of this put option is $4 per share. Option B: strike price is $40, the price of this put option is $2 per share Both options have the same time to maturity and can only be excercised on expiration date. (a) Describe you position in the two put options. (7 points) Given your answer in part a answer parts b, c and d about the combined position. (b) What is your total profit or loss per share if the stock price is $43 per share at expiration? (6 points) (c.) What is your total profit or loss per share if the stock price is $5 per share at expiration? (6 points) (d) What is your total profit or loss per share if the stock price is $80 per share at expiration? (6 points)

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

SOLUTION a To construct a position with a constant ceiling on the total profit if stock price goes down and a constant floor on the total loss if the ... View full answer

Get step-by-step solutions from verified subject matter experts