Question: You would like to use CAPM and dividend discount model (DDM) to calculate the current theoretical stock price of GREAT Ltd. Given the following

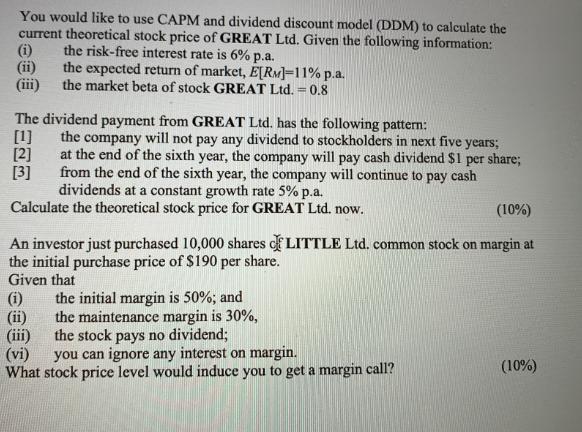

You would like to use CAPM and dividend discount model (DDM) to calculate the current theoretical stock price of GREAT Ltd. Given the following information: (i) the risk-free interest rate is 6% p.a. the expected return of market, E[RM]=11% p.a. the market beta of stock GREAT Ltd. = 0.8 (iii) The dividend payment from GREAT Ltd. has the following pattern: [1] the company will not pay any dividend to stockholders in next five years; at the end of the sixth year, the company will pay cash dividend $1 per share; from the end of the sixth year, the company will continue to pay cash dividends at a constant growth rate 5% p.a. [2] [3] Calculate the theoretical stock price for GREAT Ltd. now. (10%) An investor just purchased 10,000 shares of LITTLE Ltd. common stock on margin at the initial purchase price of $190 per share. Given that (i) the initial margin is 50%; and (ii) the maintenance margin is 30%, (iii) the stock pays no dividend; (vi) you can ignore any interest on margin. What stock price level would induce you to get a margin call? (10%)

Step by Step Solution

3.41 Rating (160 Votes )

There are 3 Steps involved in it

For GREAT Ltd Using CAPM First calculate the required return R Rf beta ERm Rf R 006 08 011 006 R 010 ... View full answer

Get step-by-step solutions from verified subject matter experts