Question: You write a call option on Amazon stock for a premium of $20. You find that the delta of the call option is 2, how

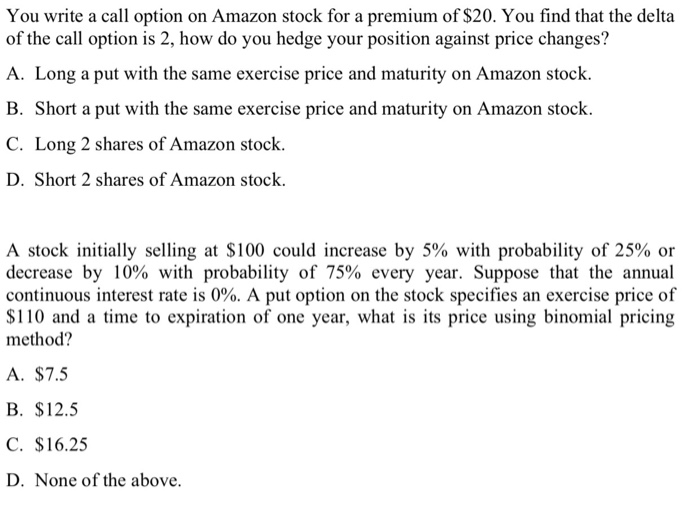

You write a call option on Amazon stock for a premium of $20. You find that the delta of the call option is 2, how do you hedge your position against price changes? A. Long a put with the same exercise price and maturity on Amazon stock. B. Short a put with the same exercise price and maturity on Amazon stock. C. Long 2 shares of Amazon stock. D. Short 2 shares of Amazon stock. A stock initially selling at $100 could increase by 5% with probability of 25% or decrease by 10% with probability of 75% every year. Suppose that the annual continuous interest rate is 0%. A put option on the stock specifies an exercise price of $110 and a time to expiration of one year, what is its price using binomial pricing method? A. $7.5 B. $12.5 C. $16.25 D. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts