Question: youl answer in the Text-Field given below. ABC Ltd. is an engineering company producing HT Drives. A new customer in the power transmission business has

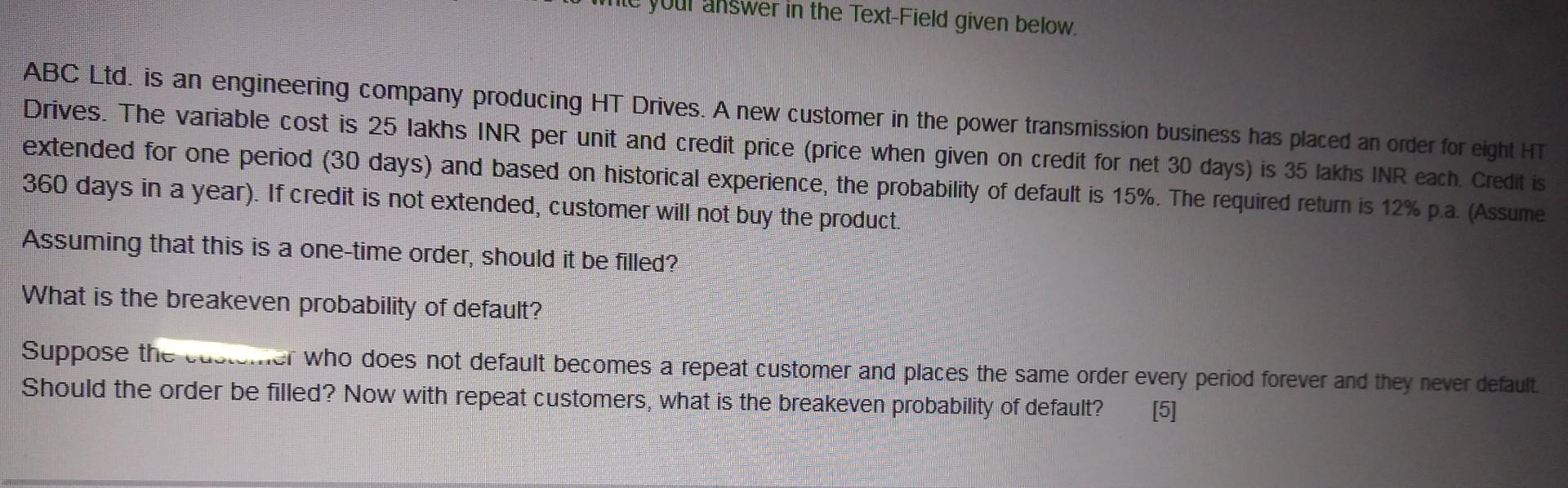

youl answer in the Text-Field given below. ABC Ltd. is an engineering company producing HT Drives. A new customer in the power transmission business has placed an order for eight HT Drives. The variable cost is 25 lakhs INR per unit and credit price (price when given on credit for net 30 days) is 35 lakhs INR each. Credit is extended for one period (30 days) and based on historical experience, the probability of default is 15%. The required return is 12% pa (Assume 360 days in a year). If credit is not extended, customer will not buy the product. Assuming that this is a one-time order, should it be filled? What is the breakeven probability of default? Suppose tht vuor...ct who does not default becomes a repeat customer and places the same order every period forever and they never default Should the order be filled? Now with repeat customers, what is the breakeven probability of default? [5]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts