Question: ****Your age is 32 Input your age for this project into cell A2. -Link cell B4 to cell B2. -Link each years Ending Account Balance

****Your age is 32

Input your age for this project into cell A2. -Link cell B4 to cell B2. -Link each years Ending Account Balance to the next years Beginning Account Balance using relative references. -Link cells C4:C44 to cell C2 using absolute references. -Link cells C45:C80 to cell D2 using absolute references. -Create a formula in cells D4:D80 to calculate Balance after Deposit/Withdraw using relative references. -Create a formula in cells E4:E80 to calculate Interest Earned using absolute and relative references. -Create a formula in cells E4:E80 to calculate Ending Account Balance using relative references. -In Cell C2, Calculate the Annual Deposit required. -In cell F2, calculate the PV of making a series of $50,000 payments, starting at the beginning of year 65 and ending at the beginning of Year 100. This represents the required Ending Account Balance at the end of Year 64 (when you retire). -In cell C2, calculate the payment required to achieve the desired Ending Account Balance at the end of Year 64 (the amount in cell F2).

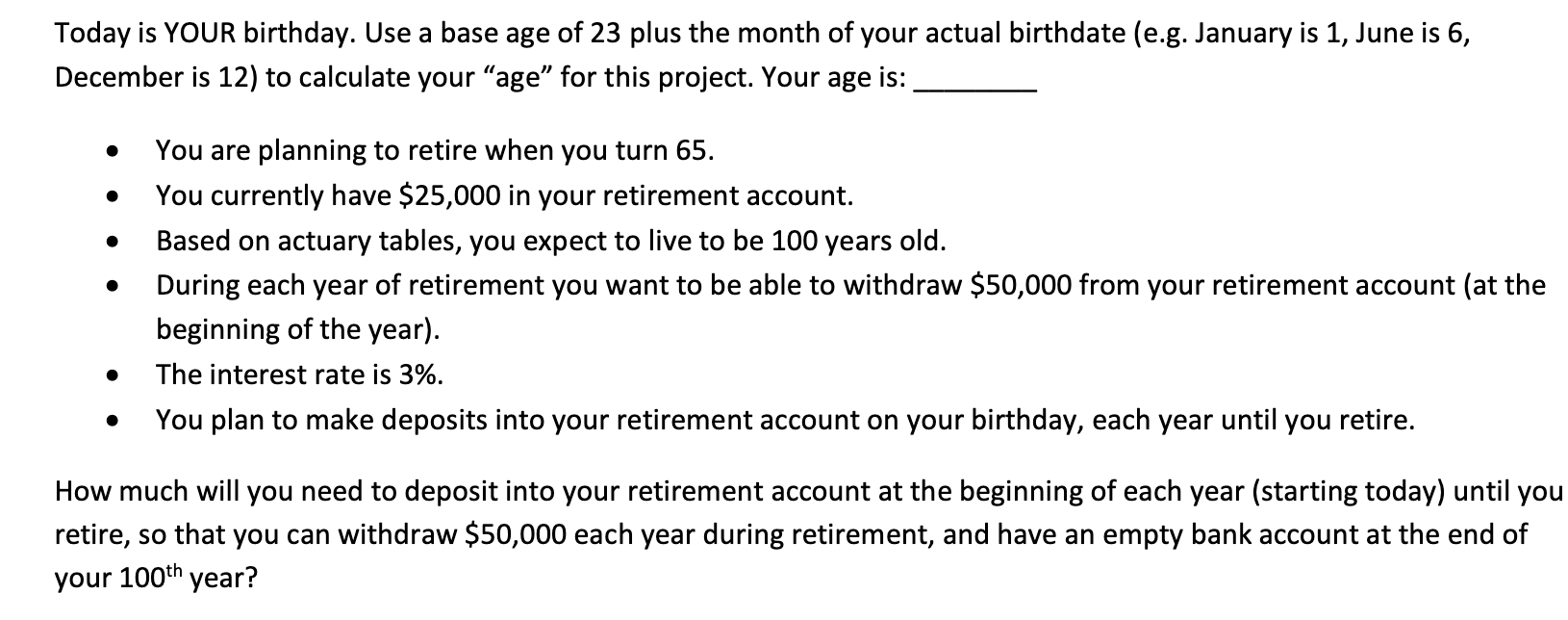

Today is YOUR birthday. Use a base age of 23 plus the month of your actual birthdate (e.g. January is 1, June is 6, December is 12) to calculate your age for this project. Your age is: . . . You are planning to retire when you turn 65. You currently have $25,000 in your retirement account. Based on actuary tables, you expect to live to be 100 years old. During each year of retirement you want to be able to withdraw $50,000 from your retirement account (at the beginning of the year). The interest rate is 3%. You plan to make deposits into your retirement account on your birthday, each year until you retire. . How much will you need to deposit into your retirement account at the beginning of each year (starting today) until you retire, so that you can withdraw $50,000 each year during retirement, and have an empty bank account at the end of your 100th year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts