Question: Your Answer: 1000 Answer Question 5 (1 point) Bavarian Sausage just issued a 9-year 7 % coupon bond. The face value of the bond is

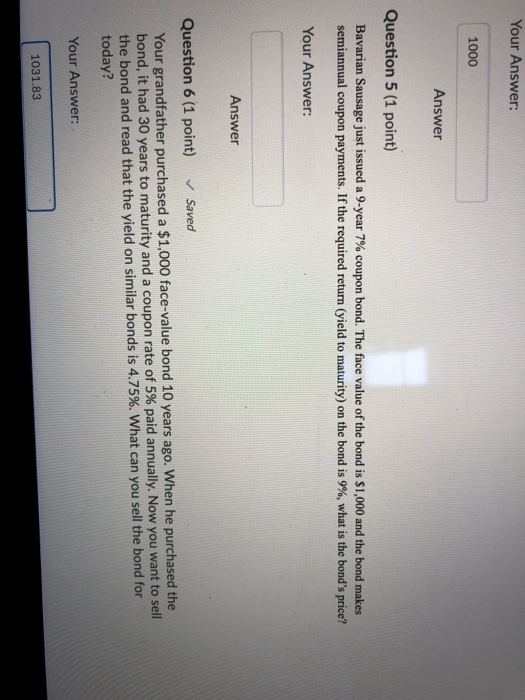

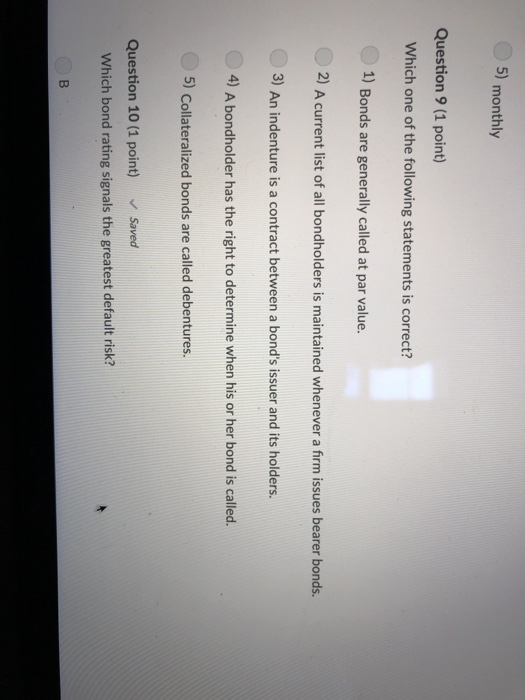

Your Answer: 1000 Answer Question 5 (1 point) Bavarian Sausage just issued a 9-year 7 % coupon bond. The face value of the bond is $1,000 and the bond makes semiannual coupon payments. If the required return (yield to maturity) on the bond is 9%, what is the bond's price? Your Answer: Answer Question 6 (1 point) Saved Your grandfather purchased a $1,000 face-value bond 10 years ago. When he purchased the bond, it had 30 years to maturity and a coupon rate of 5% paid annually. Now you want to sell the bond and read that the yield on similar bonds is 4.75%. What can you sell the bond for today? Your Answer: 1031.83 5) monthly Question 9 (1 point) Which one of the following statements is correct? 1) Bonds are generally called at par value. 2) A current list of all bondholders is maintained whenever a firm issues bearer bonds. 3) An indenture is a contract between a bond's issuer and its holders. 4) A bondholder has the right to determine when his or her bond is called. 5) Collateralized bonds are called debentures. Question 10 (1 point) Saved Which bond rating signals the greatest default risk? B

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts