Question: your answer. (2 marks) [Total 25 marks] QUESTION 3 Part A Jauhari Corporation issued 14%, 5-year bonds with a par value of RM5,000,000 on January

![your answer. (2 marks) [Total 25 marks] QUESTION 3 Part A](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6716284a40bcf_35367162849749d6.jpg)

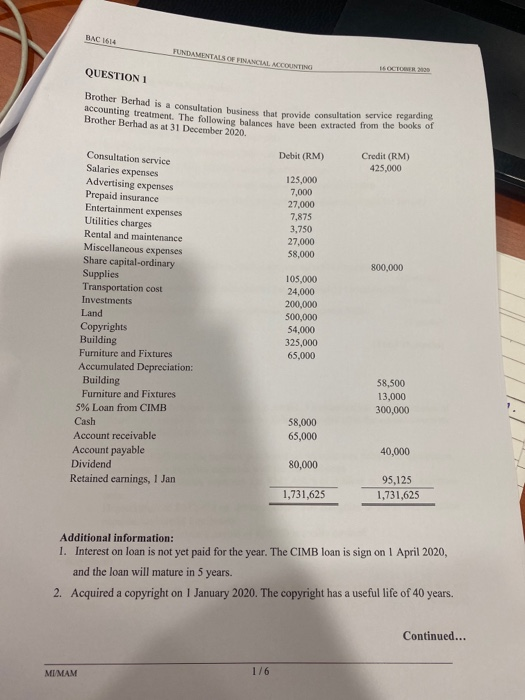

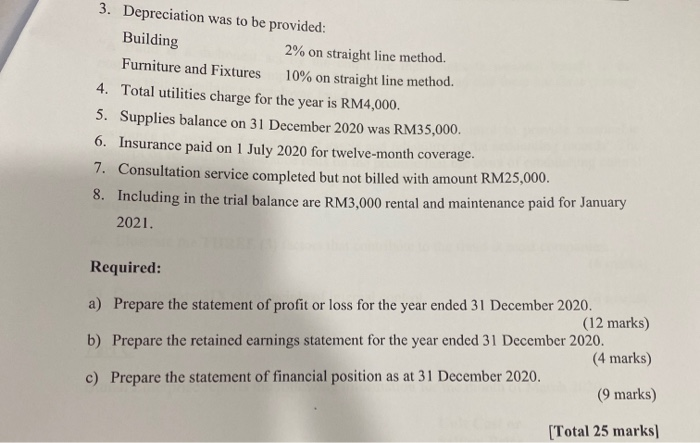

your answer. (2 marks) [Total 25 marks] QUESTION 3 Part A Jauhari Corporation issued 14%, 5-year bonds with a par value of RM5,000,000 on January 1, 2014. Interest is to be paid semiannually on each June 30 and December 31. The bonds are issued at RM5,368,035 cash when the market rate for this bond is 12%. Required 6) Prepare journal entry to record the issuance of the bonds on January 1, 2014 (1.5 marks) (0) Show how the bonds would be reported on Jauhari Corporation's Statement of Financial Position at January 1, 2014. (2 marks) (iii) Assume that Jauhari Corporation uses the effective interest method of amortization of any discount or premium on bonds. Prepare the general journal entry to record the first semi-annual interest payment on June 30, 2014. Show all workings (3 marks) BNC 1614 FUNDAMENTALS OF FINANCIAL ACCOUNTING DOCTOR QUESTION 1 Brother Berhad is a consultation business that provide consultation service regarding accounting treatment. The following balances have been extracted from the books of Brother Berhad as at 31 December 2020. Debit (RM) Credit (RM) 425,000 125,000 7,000 27,000 7,875 3,750 27,000 58,000 800,000 Supplies 105,000 Transportation cost 24,000 Investments 200,000 Land 500,000 Copyrights 54,000 Building 325,000 Furniture and Fixtures 65,000 Accumulated Depreciation: Building 58,500 Fumiture and Fixtures 13,000 5% Loan from CIMB 300,000 Cash 58,000 Account receivable 65,000 Account payable 40,000 Dividend 80,000 Retained earnings, 1 Jan 95,125 1,731,625 1,731,625 Consultation service Salaries expenses Advertising expenses Prepaid insurance Entertainment expenses Utilities charges Rental and maintenance Miscellaneous expenses Share capital-ordinary Additional information: 1. Interest on loan is not yet paid for the year. The CIMB loan is sign on 1 April 2020, and the loan will mature in 5 years. 2. Acquired a copyright on 1 January 2020. The copyright has a useful life of 40 years. Continued... MIMAM 1/6 3. Depreciation was to be provided: Building 2% on straight line method. Furniture and Fixtures 10% on straight line method. 4. Total utilities charge for the year is RM4,000. 5. Supplies balance on 31 December 2020 was RM35,000. 6. Insurance paid on 1 July 2020 for twelve-month coverage. 7. Consultation service completed but not billed with amount RM25,000. 8. Including in the trial balance are RM3,000 rental and maintenance paid for January 2021. Required: a) Prepare the statement of profit or loss for the year ended 31 December 2020. (12 marks) b) Prepare the retained earnings statement for the year ended 31 December 2020. (4 marks) c) Prepare the statement of financial position as at 31 December 2020. (9 marks) [Total 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts