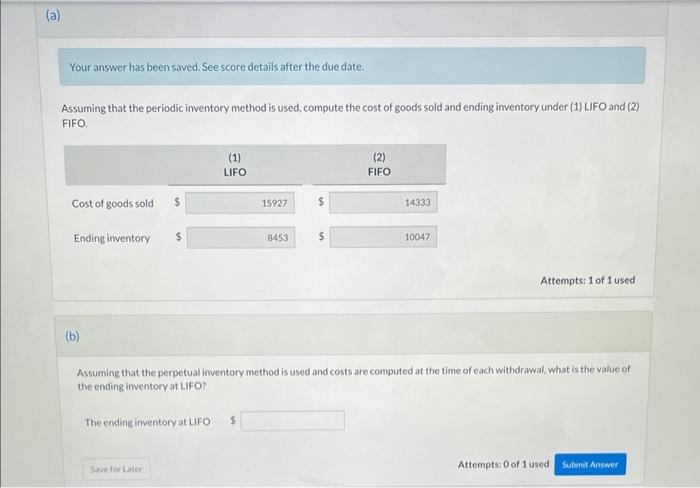

Question: Your answer has been saved. See score details after the due date. Assuming that the periodic imventory method is used, compute the cost of goods

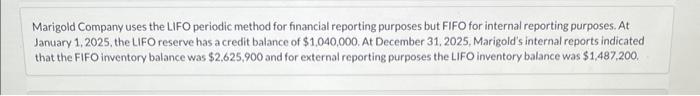

Your answer has been saved. See score details after the due date. Assuming that the periodic imventory method is used, compute the cost of goods sold and ending inventory under (1) LIFO and (2) FIFO. Attempts: 1 of 1 used (b) Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the value of the endinginventory at LIFO? The endinginventory at LIFO $ Marigold Company uses the LIFO periodic method for financial reporting purposes but FIFO for internal reporting purposes. At January 1,2025, the LIFO reserve has a credit balance of $1,040,000. At December 31, 2025, Marigold's internal reports indicated that the FIFO inventory balance was $2,625,900 and for external reporting purposes the LIFO inventory balance was $1,487,200. Your answer has been saved. See score details after the due date. Assuming that the periodic imventory method is used, compute the cost of goods sold and ending inventory under (1) LIFO and (2) FIFO. Attempts: 1 of 1 used (b) Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the value of the endinginventory at LIFO? The endinginventory at LIFO $ Marigold Company uses the LIFO periodic method for financial reporting purposes but FIFO for internal reporting purposes. At January 1,2025, the LIFO reserve has a credit balance of $1,040,000. At December 31, 2025, Marigold's internal reports indicated that the FIFO inventory balance was $2,625,900 and for external reporting purposes the LIFO inventory balance was $1,487,200

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts