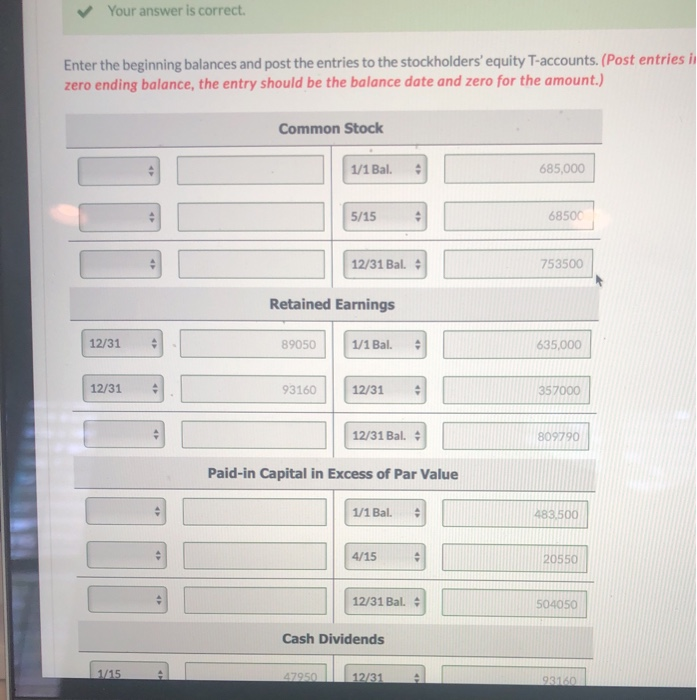

Question: Your answer is correct. Enter the beginning balances and post the entries to the stockholders' equity T-accounts. (Post entries in zero ending balance, the entry

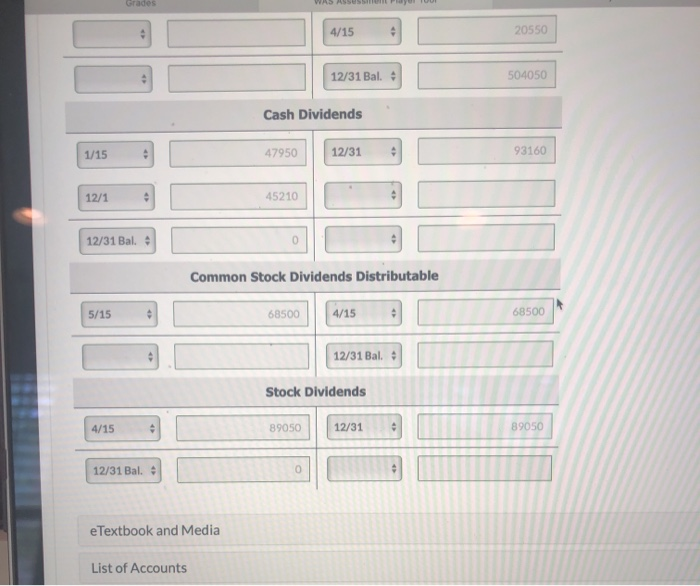

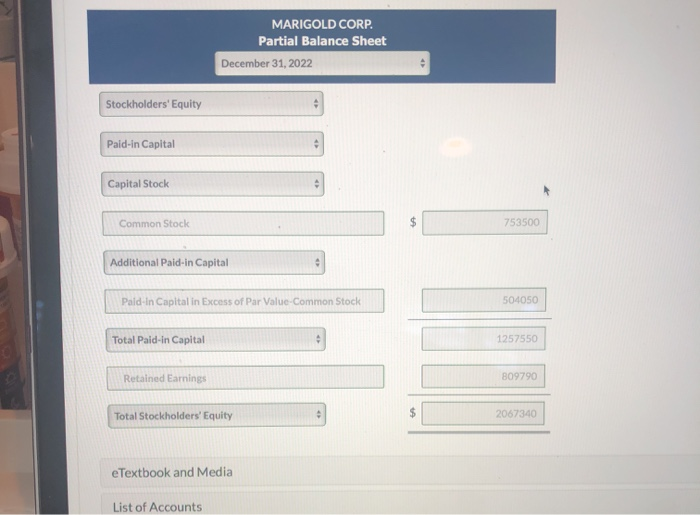

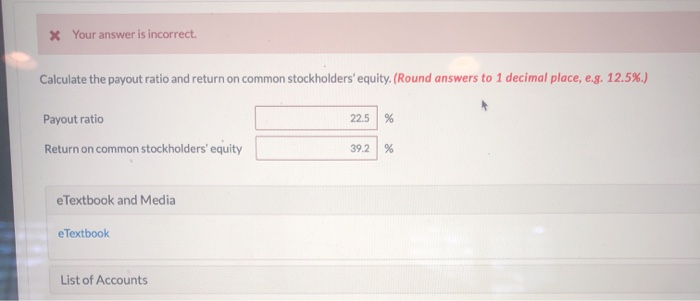

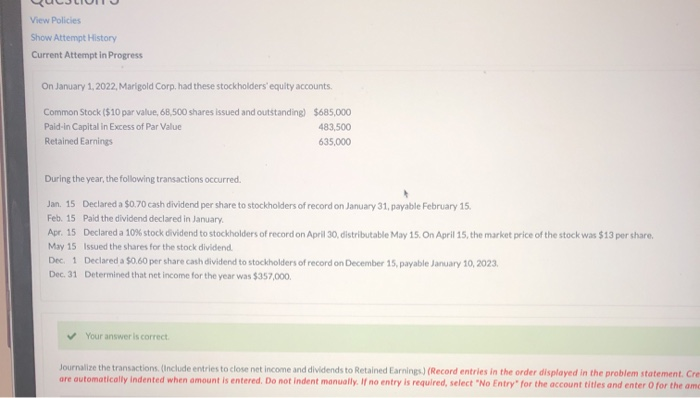

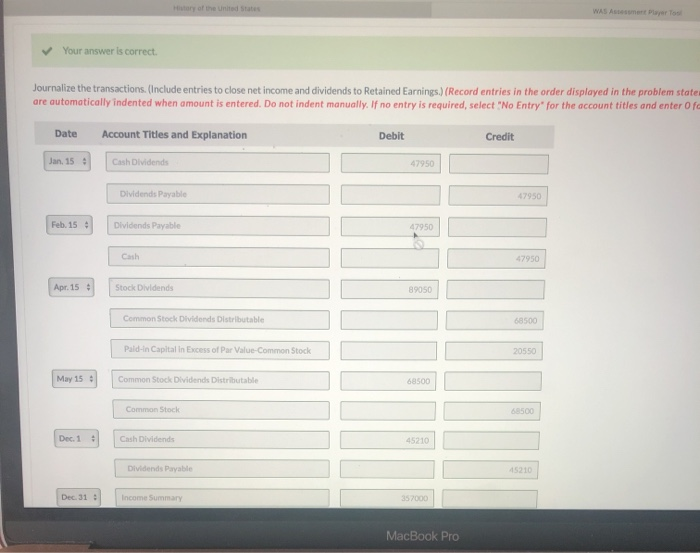

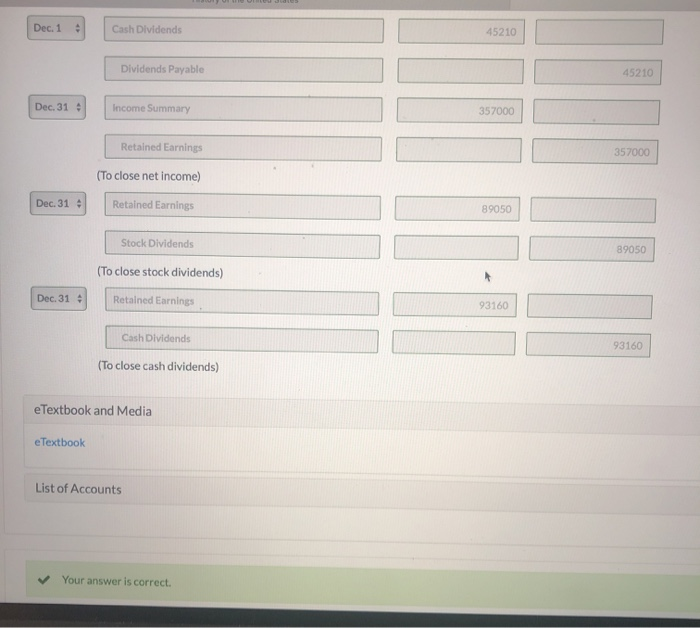

Your answer is correct. Enter the beginning balances and post the entries to the stockholders' equity T-accounts. (Post entries in zero ending balance, the entry should be the balance date and zero for the amount.) Common Stock 1/1 Bal. 685,000 5/15 68500 12/31 Bal - 753500 Retained Earnings 12/31 - 89050 1/1 Bal. 635,000 12/31 93160 12/31 357000 12/31 Bal. 809790 Paid-in Capital in Excess of Par Value 1/1 Bal. 483 500 4/15 20550 12/31 Bal. 504050 Cash Dividends 4 7950 12/31 AT 215A 9810 crados 4/15 4/15 20550 | 12/31 Bal. 504050 Cash Dividends 1/15 47950 12/31 93160 12/1 45210 12/31 Bal. Common Stock Dividends Distributable 5/15 68500 4/15 68500 12/31 Bal. Stock Dividends 4/15 89050 12/31 89050 12/31 Bal. eTextbook and Media List of Accounts MARIGOLD CORP. Partial Balance Sheet December 31, 2022 Stockholders' Equity Paid-in Capital Capital Stock Common Stock 753500 Additional Paid-in Capital Pald-in Capital in Excess of Par Value-Common Stock 504050 Total Paid-in Capital 1257550 Retained Earnings 809790 Total Stockholders' Equity 2067340 e Textbook and Media List of Accounts X Your answer is incorrect. Calculate the payout ratio and return on common stockholders' equity. (Round answers to 1 decimal place, e.g. 12.5%.) Payout ratio 22.5 Return on common stockholders' equity 39.2 eTextbook and Media eTextbook List of Accounts CUCJLIULU View Policies Show Attempt History Current Attempt in Progress On January 1, 2022, Marigold Corp, had these stockholders'equity accounts Common Stock ($10 par value, 68,500 shares issued and outstanding) $685,000 Paid-in Capital in Excess of Par Value 483,500 Retained Earnings 635,000 During the year, the following transactions occurred. Jan. 15 Declared a $0,70 cash dividend per share to stockholders of record on January 31, payable February 15. Feb. 15 Paid the dividend declared in January Apr. 15 Declared a 10% stock dividend to stockholders of record on April 30, distributable May 15. On April 15, the market price of the stock was $13 per share. May 15 Issued the shares for the stock dividend Dec. 1 Declared a $0.60 per share cash dividend to stockholders of record on December 15, payable January 10, 2023 Dec 31 Determined that net income for the year was $357,000. Your answer is correct. Journalize the transactions. (Include entries to close net income and dividends to Retained Earnings.) (Record entries in the order displayed in the problem statement. Ce are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amo Your answer is correct Journalize the transactions. (Include entries to close net income and dividends to Retained Earnings.) (Record entries in the order displayed in the problem state are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter of Date Account Titles and Explanation Debit Credit | Cash Dividends 47950 Dividends Payable 57950 Feb. 15 Dividends Payable Apr. 15 Stock Dividends 89050 Common Stock Dividends Distributable Pald-in Capital In Excess of Par Value-Common Stock May 15 Common Stock Dividends Distributable Common Stock 63500 Dec. 1 : Cash Dividends I orvidonds Pavable MacBook Pro 45210 Dec 1 : Cash Dividends 45210 Dividends Payable Dec. 31 Income Summary 357000 Retained Earnings 357000 (To close net income) Dec. 31 Retained Earnings 89050 89050 Stock Dividends (To close stock dividends) Dec.31 : Retained Earnings 93160 Cash Dividends 93160 (To close cash dividends) eTextbook and Media e Textbook List of Accounts Your answer is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts