Question: Your answer is correct. Prepare the journal entry to record the sale of the available - for - sale debt securities in 2 0 2

Your answer is correct.

Prepare the journal entry to record the sale of the availableforsale debt securities in List all debit entries before credit entries. Credit account titles are automatically indented when

amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts.

Account Titles and Explanation

Debit

Credit

Cash

Gain on Sale of Investments

Debt Investments

eTextbook and Media b

Your answer is incorrect.

Prepare the journal entry to record the Unrealized Holding Gain or Loss for List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do

not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts.

Account Titles and Explanation

Debit

Credit

Unrealized Holding Gain or LossEquity

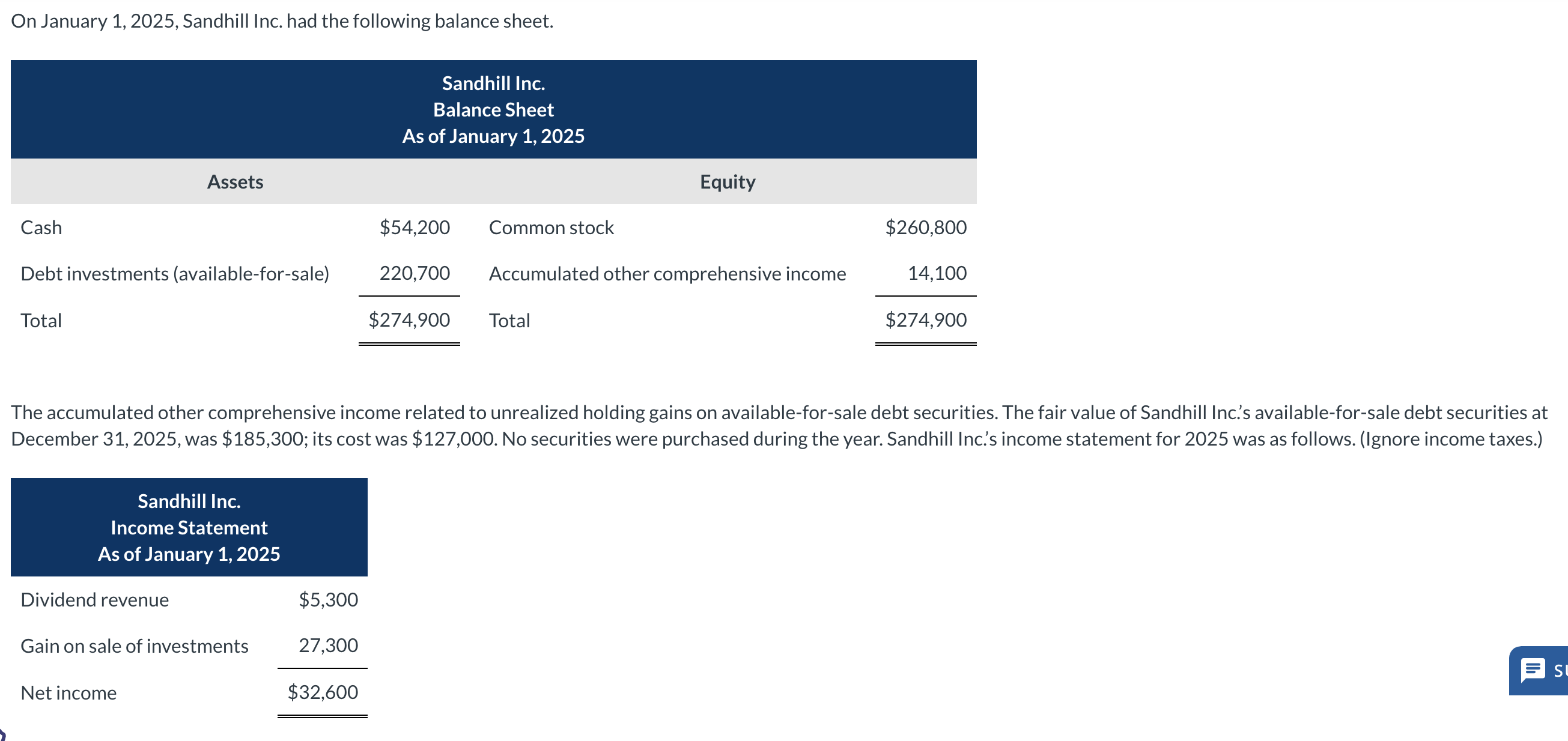

On January Sandhill Inc. had the following balance sheet.

The accumulated other comprehensive income related to unrealized holding gains on availableforsale debt securities The fair value of Sandhill Inc.s availableforsale debt securities at

December was $; its cost was $ No securities were purchased during the year. Sandhill Inc.s income statement for was as follows. Ignore income taxes.

Sandhill Inc.

Income Statement

As of January

Solve question B question A is correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock