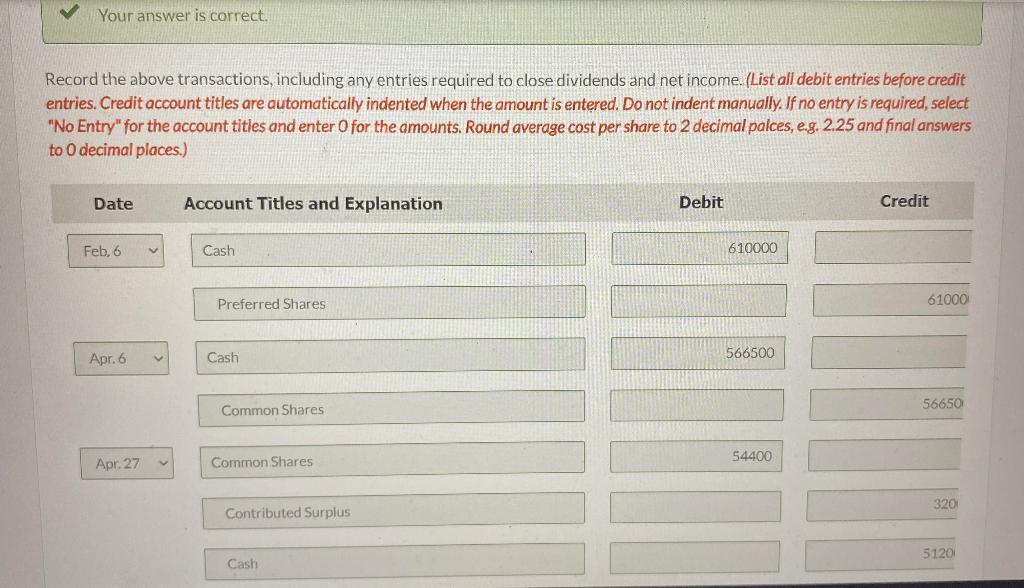

Question: Your answer is correct. Record the above transactions, including any entries required to close dividends and net income. (List all debit entries before credit entries.

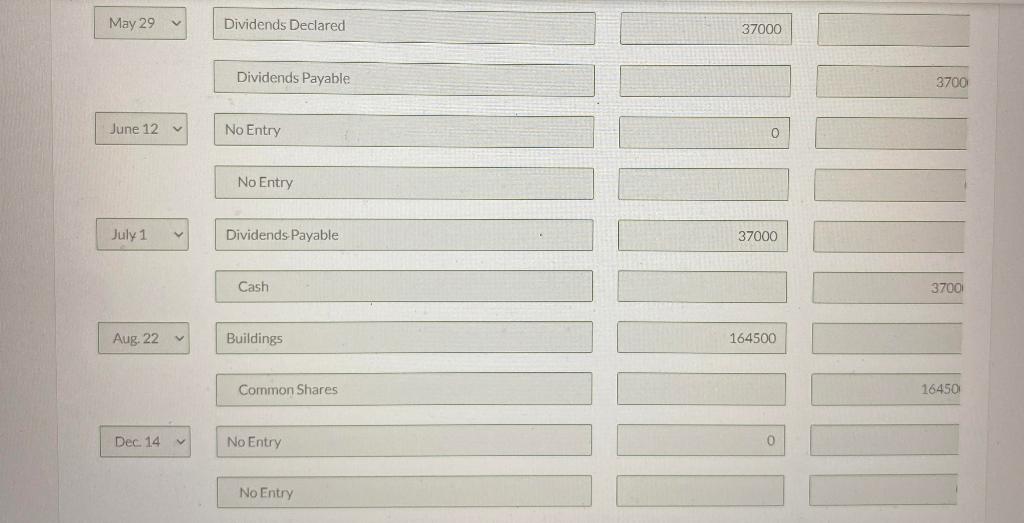

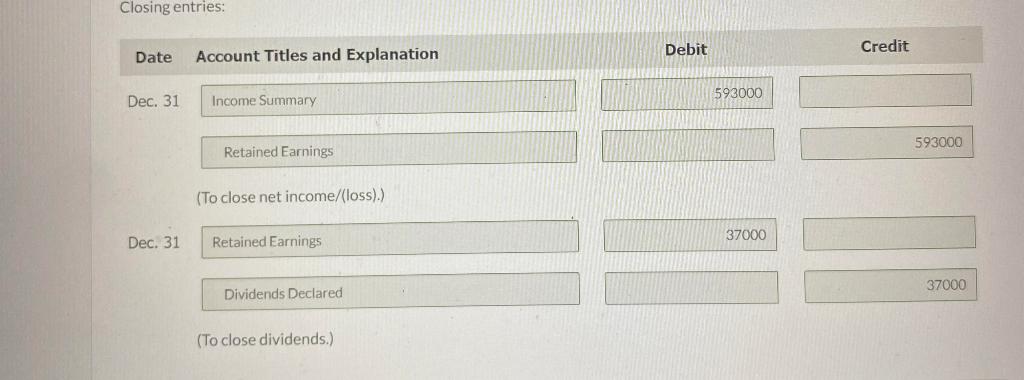

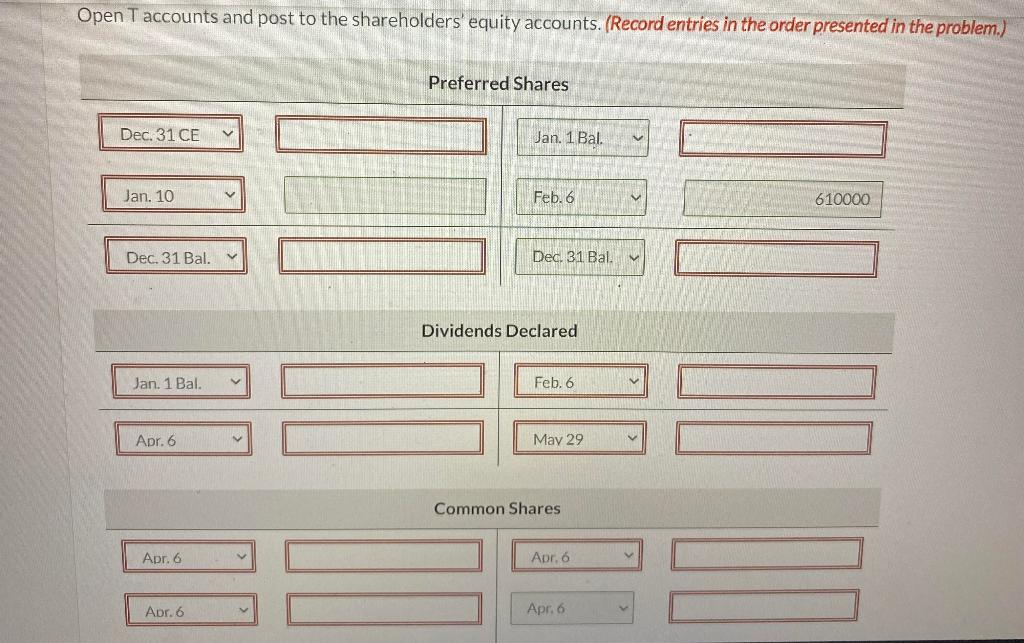

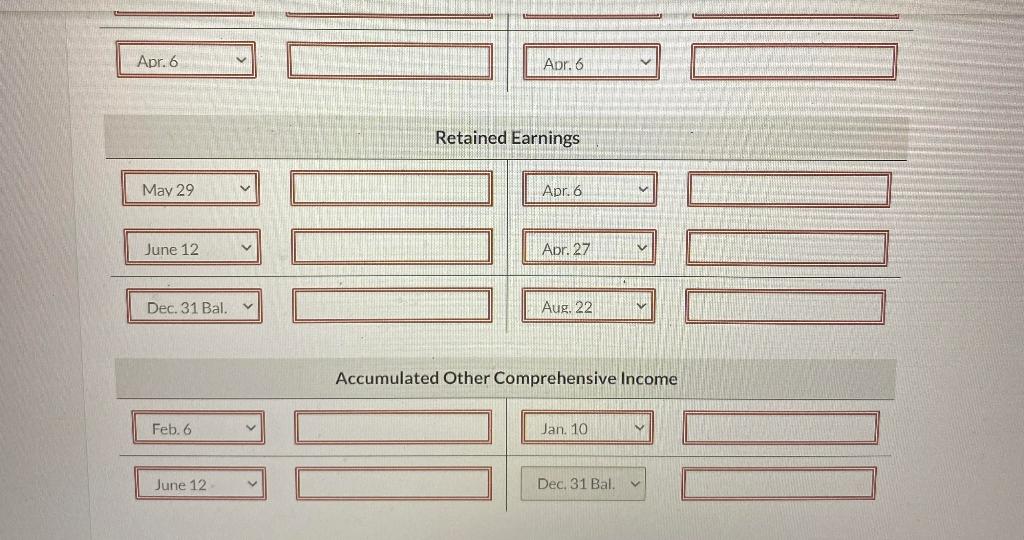

Your answer is correct. Record the above transactions, including any entries required to close dividends and net income. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round average cost per share to 2 decimal palces, e.g. 2.25 and final answers to 0 decimal places.) \begin{tabular}{|lrr|} \hline May 29 & 37000 \\ \hline \end{tabular} Dividends Payable June 12 No Entry No Entry Closing entries: Open T accounts and post to the shareholders' equity accounts. (Record entries in the order presented in the problem.) Retained Earnings \begin{tabular}{|ll|} \hline May 29 \\ \hline \end{tabular} Apr. 6 June 12 Abr. 27 Dec. 31Bal Aug. 22 Accumulated Other Comprehensive Income Feb. 6 Jan. 10 June 12 Dec. 31Bal Your answer is correct. Record the above transactions, including any entries required to close dividends and net income. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Round average cost per share to 2 decimal palces, e.g. 2.25 and final answers to 0 decimal places.) \begin{tabular}{|lrr|} \hline May 29 & 37000 \\ \hline \end{tabular} Dividends Payable June 12 No Entry No Entry Closing entries: Open T accounts and post to the shareholders' equity accounts. (Record entries in the order presented in the problem.) Retained Earnings \begin{tabular}{|ll|} \hline May 29 \\ \hline \end{tabular} Apr. 6 June 12 Abr. 27 Dec. 31Bal Aug. 22 Accumulated Other Comprehensive Income Feb. 6 Jan. 10 June 12 Dec. 31Bal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts