Question: Your answer is incorrect Compute Metlock's June 30,2017, inventory under the conventional retail method of accounting for inventories. (Round ratios for computational purposes to 0

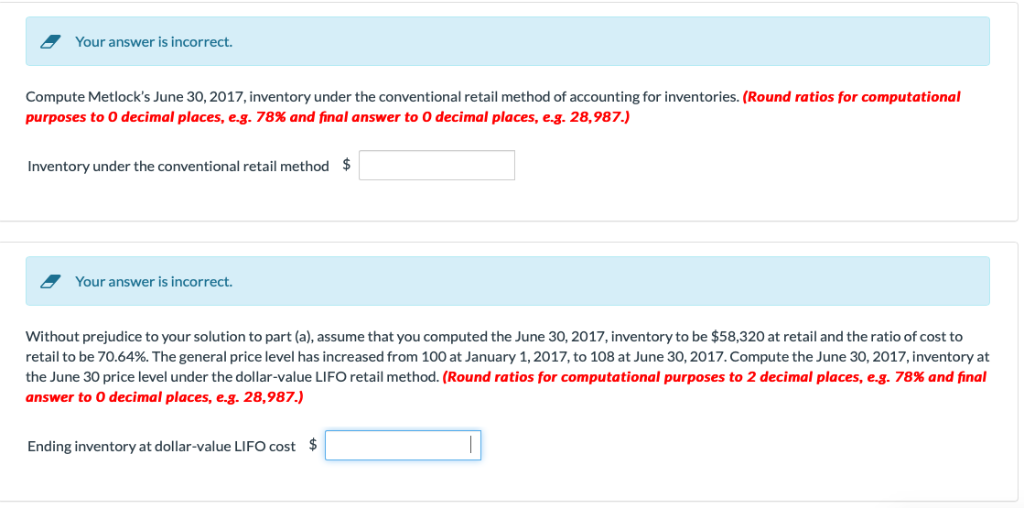

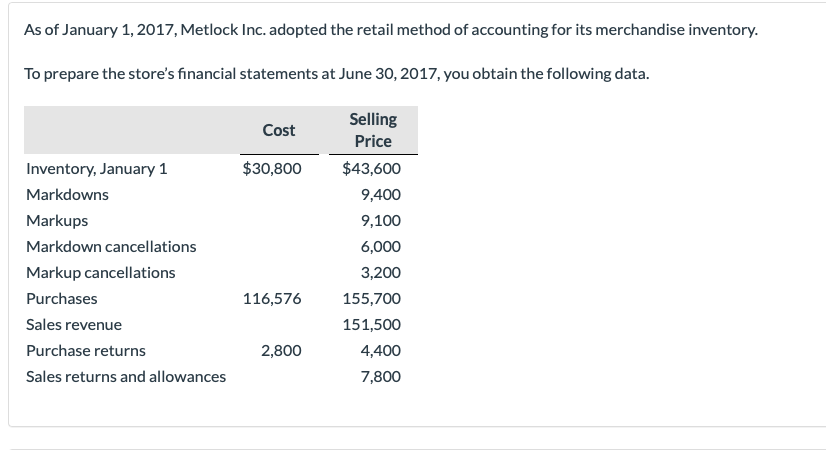

Your answer is incorrect Compute Metlock's June 30,2017, inventory under the conventional retail method of accounting for inventories. (Round ratios for computational purposes to 0 decimal places, eg. 78% and final answer to 0 decimal places, eg. 28,987.) Inventory under the conventional retail method $ Your answer is incorrect. Without prejudice to your solution to part (a), assume that you computed the June 30, 2017, inventory to be $58,320 at retail and the ratio of cost to retail to be 70.64%. The general price level has increased from 100 at January 1, 2017, to 108 at June 30, 2017, Compute the June 3 ,2017,inventor/at the June 30 price level under the dollar-value LIFO retail method. (Round ratios for computational purposes to 2 decimal places, e.g. 78% and final answer to O decimal places, e.g 28,987.) Ending inventory at dollar-value LIFO cost $ As of January 1, 2017, Metlock Inc. adopted the retail method of accounting for its merchandise inventory To prepare the store's financial statements at June 30, 2017, you obtain the following data Selling Cost Price Inventory, January 1 Markdowns Markups Markdown cancellations Markup cancellations Purchases Sales revenue Purchase returns Sales returns and allowances $30,800 $43,600 9,400 9,100 6,000 3,200 155,700 151,500 4,400 7,800 116,576 2,800

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts