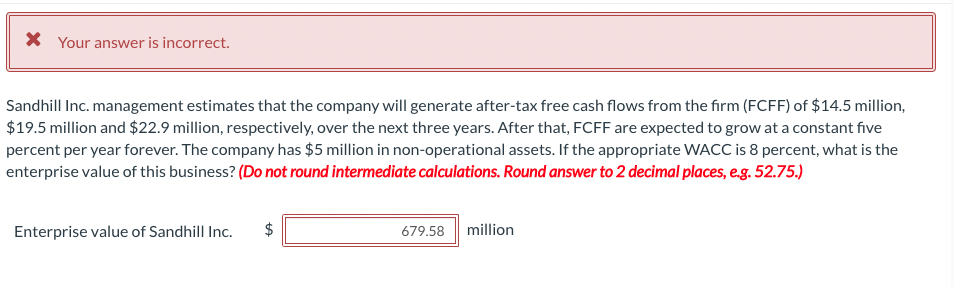

Question: * Your answer is incorrect. Sandhill Inc. management estimates that the company will generate after-tax free cash flows from the firm (FCFF) of $14.5 million,

* Your answer is incorrect. Sandhill Inc. management estimates that the company will generate after-tax free cash flows from the firm (FCFF) of $14.5 million, $19.5 million and $22.9 million, respectively, over the next three years. After that, FCFF are expected to grow at a constant five percent per year forever. The company has $5 million in non-operational assets. If the appropriate WACC is 8 percent, what is the enterprise value of this business? (Do not round intermediate calculations. Round answer to 2 decimal places, eg. 52.75.) Enterprise value of Sandhill Inc. TA $ 679.58 | million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts