Question: Your answer is incorrect. Try again. Compute the amount of accumulated depreciation on each bus at December 31, 2017. (Round depreciation cost per unit to

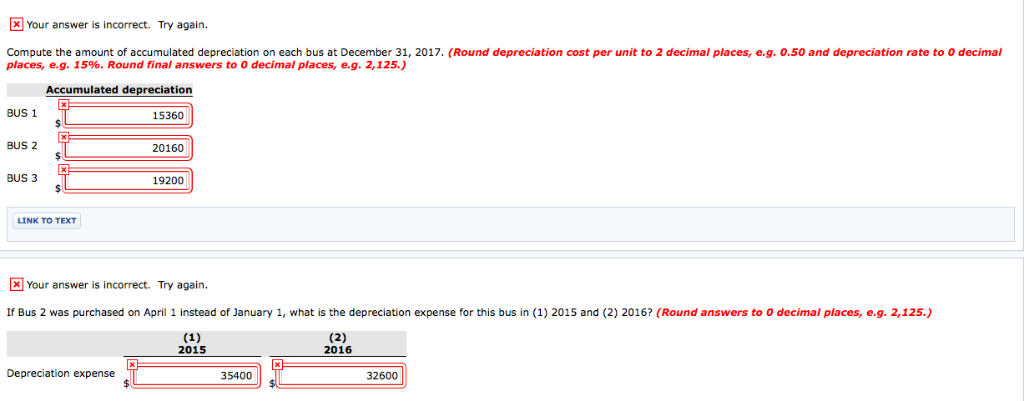

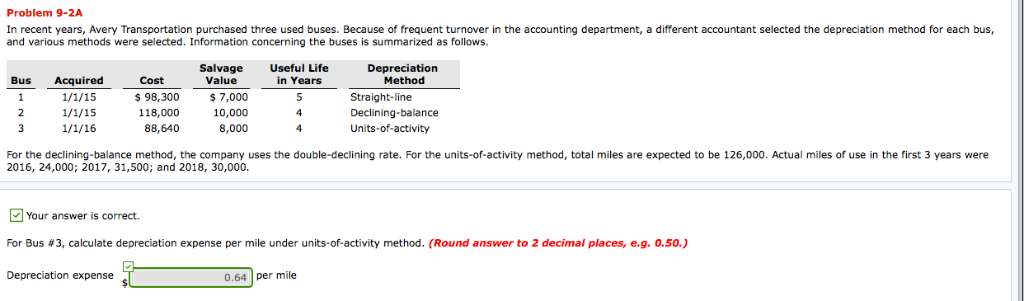

Your answer is incorrect. Try again. Compute the amount of accumulated depreciation on each bus at December 31, 2017. (Round depreciation cost per unit to 2 decimal places, e.g. O.50 and depreciation rate to O decimal places, e.g. 15%. Round final answers to 0 decimal places, eg. 2,125.) Accumulated depreciation BUS 1 15360 BUS 2 20160 BUS 3 19200 LINK TO TEXT Your answer is incorrect. Try again. If Bus 2 was purchased on April 1 instead of January 1, what is the depreciation expense for this bus in (1) 2015 and (2) 2016? (Round answers to O decimal places, e.g. 2,125. 2015 2016 Depreciation expense 35400 32600 Problem 9-2A In recent years, Avery Transportation purchased three used buses. Because of frequent turnover in the accounting department, a different accountant selected the depreciation method for each bus, and various methods were selected. Information concerning the buses is summarized as follows Salvage Depreciation Useful Life in Years Bus Acquired Value Cost 98,300 118,000 Method 7,000 10,000 8,000 Straight-line Declining-balance Units-of-activity 88,640 For the declining-balance method, the company uses the double-declining rate. For the units-of-activity method, total miles are expected to be 126,000. Actual miles of use in the first 3 years were 2016, 24,000; 2017, 31,500; and 2018, 30,000. Your answer is correct. For Bus #3, calculate depreciation expense per mile under units-of-activity method. (Round answer to 2 decimal places, e.g. 0.50.) Depreciation expense 0.64 per mile

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts