Question: Your answer is partially correct. At the end of 2 0 2 6 , Magilke is evaluating the results of the instructional business. Due to

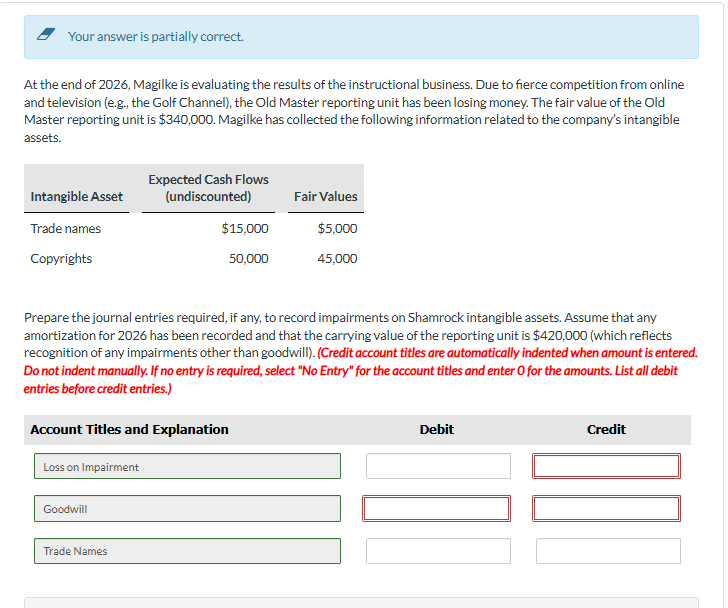

Your answer is partially correct. At the end of Magilke is evaluating the results of the instructional business. Due to fierce competition from online and television eg the Golf Channel the Old Master reporting unit has been losing money. The fair value of the Old Master reporting unit is $ Magilke has collected the following information related to the company's intangible assets.Expected Cash Flows undiscounted Prepare the journal entries required, if any, to record impairments on Shamrock intangible assets. Assume that any amortization for has been recorded and that the carrying value of the reporting unit is $ which reflects recognition of any impairments other than goodwillCredit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Loss on Impairment Goodwill Trade Names Your answer is correct.

Prepare the journal entry to record amortization expense for Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.

Prepare the intangible assets section of Shamrock Golf Inc. at December No impairments are required to be recorded in

SHAMROCK GOLF INC.

Intangibles Section of Balance Sheet

December

Trade Names

$

Copyrights

Goodwill

eTextbook and Media

List of Accounts Your answer is partially correct.

At the end of Magilke is evaluating the results of the instructional business. Due to fierce competition from online and television eg the Golf Channel the Old Master reporting unit has been losing money. The fair value of the Old Master reporting unit is $ Magilke has collected the following information related to the company's intangible assets.Expected Cash Flows undiscounted

Prepare the journal entries required, if any, to record impairments on Shamrock intangible assets. Assume that any amortization for has been recorded and that the carrying value of the reporting unit is $ which reflects recognition of any impairments other than goodwillCredit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for the amounts. List all debit entries before credit entries.

Account Titles and Explanation

Loss on Impairment

Goodwill

Debit

Credit

square

eTextbook and Media

List of Accounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock