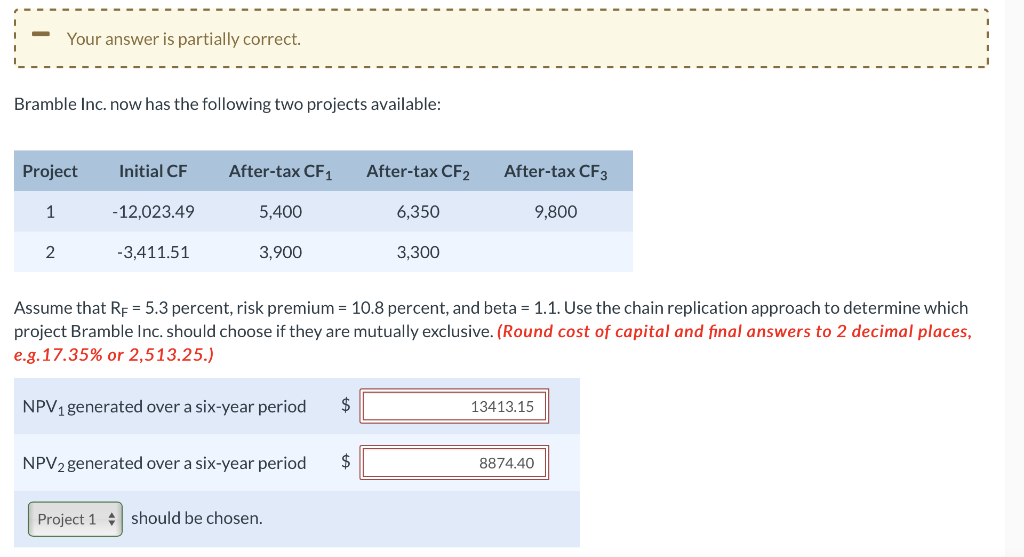

Question: Your answer is partially correct. Bramble Inc. now has the following two projects available: Project Initial CF After-tax CF1 After-tax CF2 After-tax CF3 1 -12,023.49

Your answer is partially correct. Bramble Inc. now has the following two projects available: Project Initial CF After-tax CF1 After-tax CF2 After-tax CF3 1 -12,023.49 5,400 6,350 9,800 2 -3,411.51 3,900 3,300 Assume that RF = 5.3 percent, risk premium = 10.8 percent, and beta = 1.1. Use the chain replication approach to determine which project Bramble Inc. should choose if they are mutually exclusive. (Round cost of capital and final answers to 2 decimal places, e.g. 17.35% or 2,513.25.) NPV1 generated over a six-year period $ 13413.15 NPV2 generated over a six-year period $ 8874.40 Project 1 should be chosen

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts