Question: Your answer is partially correct. Effective - Interest Method Bonds Sold to Yield Prepare all of the relevant journal e Carla Co . sells $

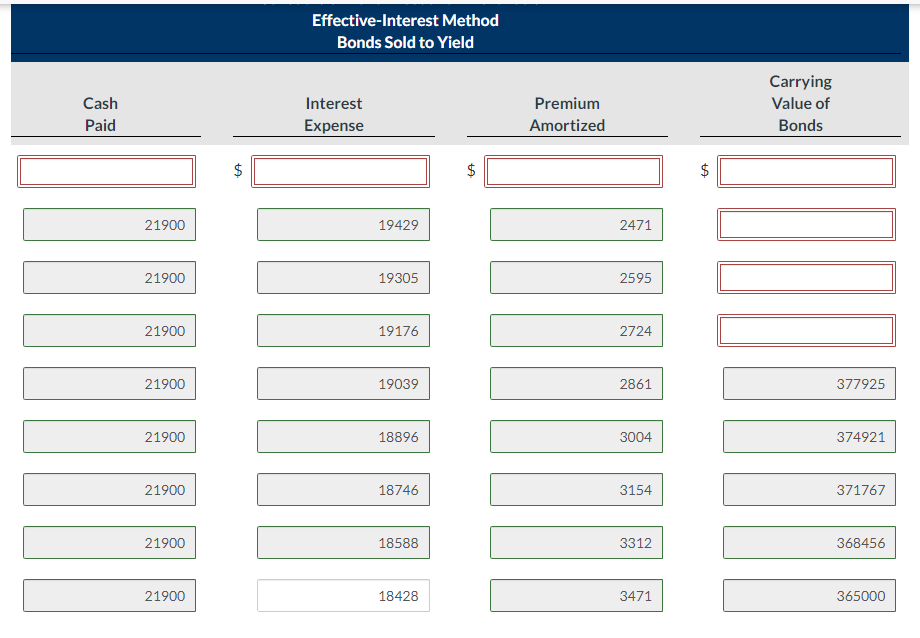

Your answer is partially correct. EffectiveInterest Method

Bonds Sold to Yield Prepare all of the relevant journal e

Carla Co sells $ of bonds on June The bonds pay interest on December and June The due date of the

bonds is June The bond yield On October Carla Buys back $ worth of bonds for

includes accrued interest Give entries through December

Prepare a bond amortization schedule using the effectiveinterest method for discount and premium amortization. Amortize

premium or discount on interest dates and at yearend. Round answers to decimal places, eg Please help

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock