Question: Your answer is partially correct. Enter the December 1 balances in the ledger T - accounts and post the December transactions. In addition to the

Your answer is partially correct.

Enter the December balances in the ledger Taccounts and post the December transactions. In addition to the accounts

mentioned above, use the following additional accounts: Cost of Goods Sold, Depreciation Expense, Salaries and Wages Expense,

Salaries and Wages Payable, Sales Revenue, and Sales Returns and Allowances. Post entries in the order of journal entries presented

above.

Accounts Receivable e

Your answer is incorrect.

Compute ending inventory and cost of goods sold under FIFO, assuming Cullumber Company uses the periodic inventory system.

Ending Inventory

Cost of Goods Sold

$

eTextbook and Media

List of Accounts

Attempts: of used

f

Compute ending inventory and cost of goods sold under LIFO, assuming Cullumber Company uses the periodic inventory system.

Ending Inventory

Cost of Goods Sold

$

eTextbook and Media

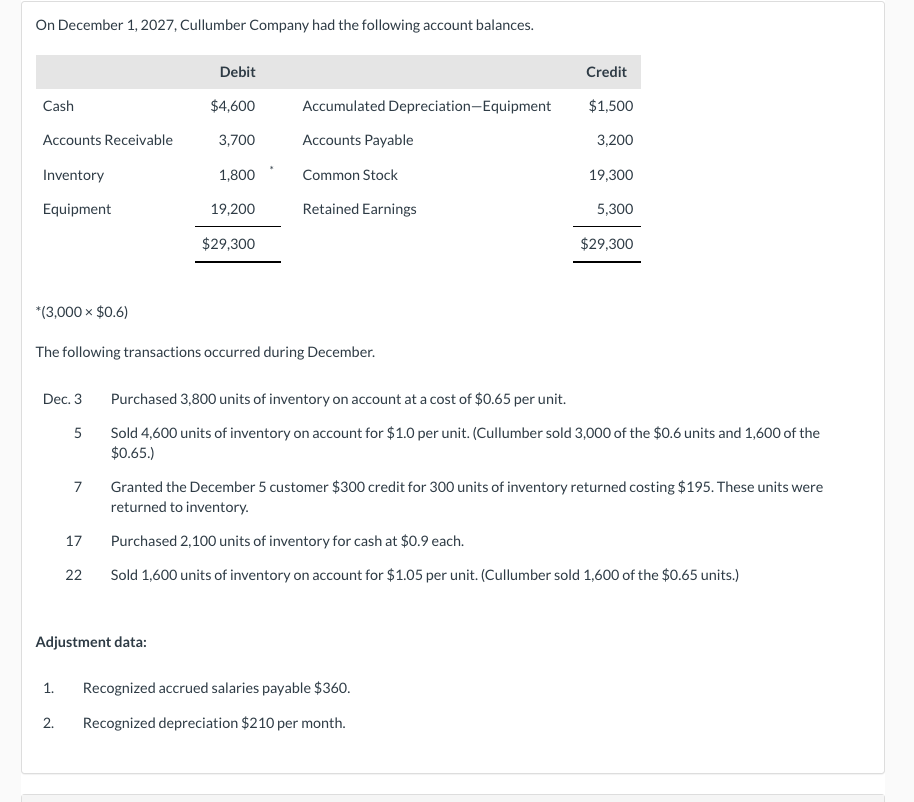

List of AccountsOn December Cullumber Company had the following account balances.

$

The following transactions occurred during December.

Dec. Purchased units of inventory on account at a cost of $ per unit.

Sold units of inventory on account for $ per unit. Cullumber sold of the $ units and of the

$

Granted the December customer $ credit for units of inventory returned costing $ These units were

returned to inventory.

Purchased units of inventory for cash at $ each.

Sold units of inventory on account for $ per unit. Cullumber sold of the $ units.

Adjustment data:

Recognized accrued salaries payable $

Recognized depreciation $ per month.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock