Question: Your answer is partially correct. Marigold sells 20 non-refundable $100 gift cards for 3D cartridges on March 1, 2022. The cartridges have a standalone selling

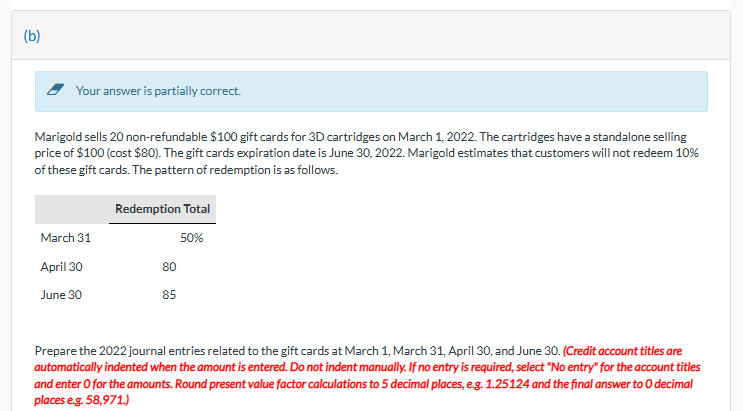

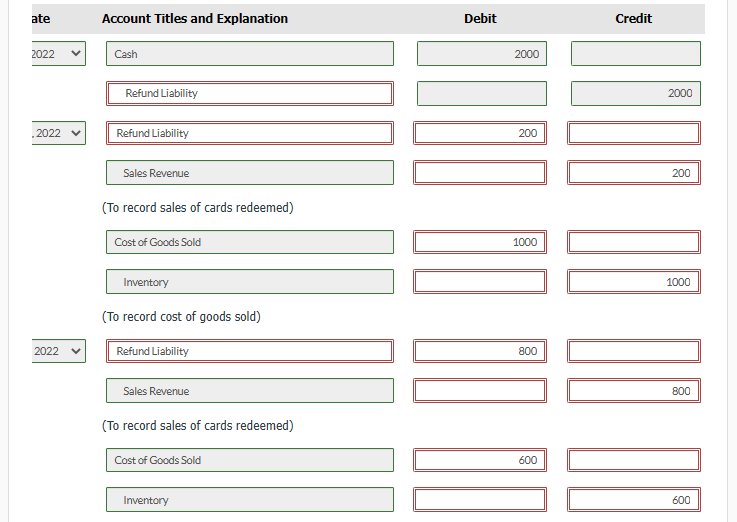

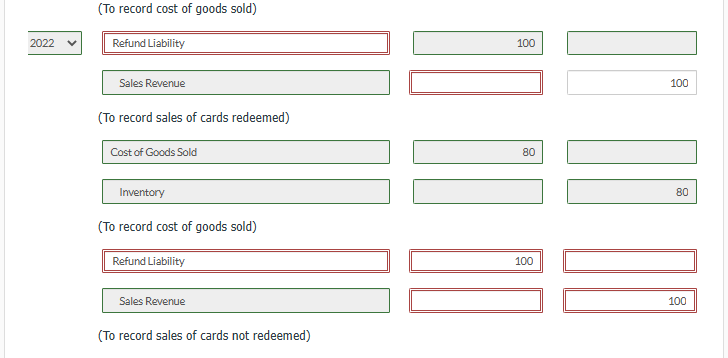

Your answer is partially correct. Marigold sells 20 non-refundable $100 gift cards for 3D cartridges on March 1, 2022. The cartridges have a standalone selling price of $100 (cost $80 ). The gift cards expiration date is June 30 , 2022. Marigold estimates that customers will not redeem 10% of these gift cards. The pattern of redemption is as follows. Prepare the 2022 journal entries related to the gift cards at March 1, March 31, April 30, and June 30. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) Refund Liability \begin{tabular}{l|l||} \hline .2022 Refund Liability & 200 \\ \hline \end{tabular} Sales Revenue (To record sales of cards redeemed) Cost of Goods Sold \begin{tabular}{|r|} \hline \hline 1000 \\ \hline \hline \end{tabular} Inventory \begin{tabular}{|l|} \hline 1000 \\ \hline \hline \end{tabular} (To record cost of goods sold) \begin{tabular}{rl|} \hline 2022 Refund Liability \\ \hline \hline & Sales Revenue \\ & \end{tabular} \begin{tabular}{|r|} \hline 800 \\ \hline \end{tabular} (To record sales of cards redeemed) Cost of Goods Sold \begin{tabular}{|r|} \hline 600 \\ \hline \hline \end{tabular} Inventory 600 (To record cost of goods sold) 2022 \begin{tabular}{|l||} \hline Refund Liability \\ \hline \end{tabular} 100 Sales Revenue (To record sales of cards redeemed) Cost of Goods Sold 80 Inventory (To record cost of goods sold) Refund Liability 100 Sales Revenue (To record sales of cards not redeemed) Your answer is partially correct. Marigold sells 20 non-refundable $100 gift cards for 3D cartridges on March 1, 2022. The cartridges have a standalone selling price of $100 (cost $80 ). The gift cards expiration date is June 30 , 2022. Marigold estimates that customers will not redeem 10% of these gift cards. The pattern of redemption is as follows. Prepare the 2022 journal entries related to the gift cards at March 1, March 31, April 30, and June 30. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the final answer to 0 decimal places e.g. 58,971.) Refund Liability \begin{tabular}{l|l||} \hline .2022 Refund Liability & 200 \\ \hline \end{tabular} Sales Revenue (To record sales of cards redeemed) Cost of Goods Sold \begin{tabular}{|r|} \hline \hline 1000 \\ \hline \hline \end{tabular} Inventory \begin{tabular}{|l|} \hline 1000 \\ \hline \hline \end{tabular} (To record cost of goods sold) \begin{tabular}{rl|} \hline 2022 Refund Liability \\ \hline \hline & Sales Revenue \\ & \end{tabular} \begin{tabular}{|r|} \hline 800 \\ \hline \end{tabular} (To record sales of cards redeemed) Cost of Goods Sold \begin{tabular}{|r|} \hline 600 \\ \hline \hline \end{tabular} Inventory 600 (To record cost of goods sold) 2022 \begin{tabular}{|l||} \hline Refund Liability \\ \hline \end{tabular} 100 Sales Revenue (To record sales of cards redeemed) Cost of Goods Sold 80 Inventory (To record cost of goods sold) Refund Liability 100 Sales Revenue (To record sales of cards not redeemed)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts