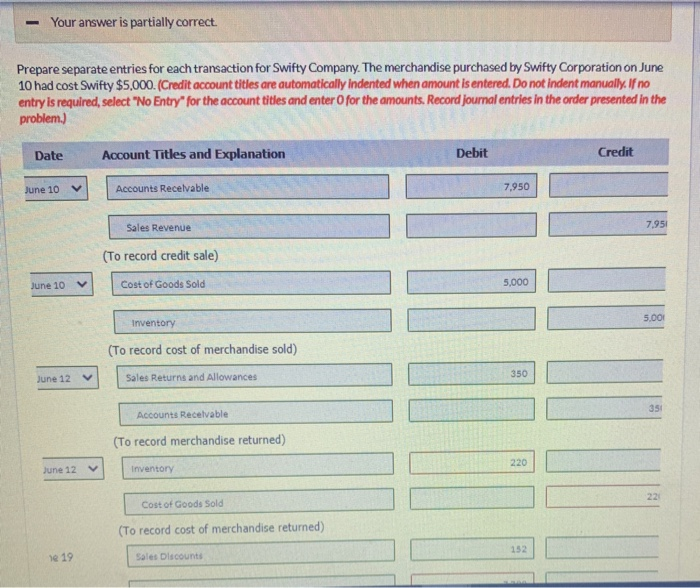

Question: - Your answer is partially correct. Prepare separate entries for each transaction for Swifty Company. The merchandise purchased by Swifty Corporation on June 10 had

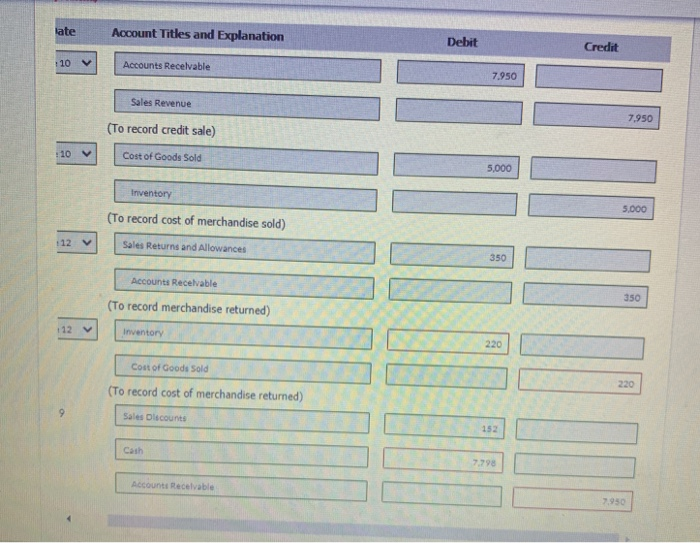

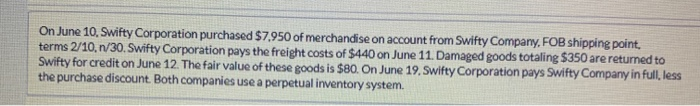

- Your answer is partially correct. Prepare separate entries for each transaction for Swifty Company. The merchandise purchased by Swifty Corporation on June 10 had cost Swifty $5,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit June 10 Accounts Receivable 7,950 Sales Revenue 7.951 (To record credit sale) June 10 Cost of Goods Sold 5,000 5.00 Inventory (To record cost of merchandise sold) Sales Returns and Allowances V June 12 350 35 Accounts Receivable (To record merchandise returned) 220 June 12 V Inventory 22 Cost of Goods Sold (To record cost of merchandise returned) 152 se 19 Sales Discounts late Account Titles and Explanation Debit Credit 10 V Accounts Recevable 7.950 Sales Revenue 7,950 (To record credit sale) :10 V Cost of Goods Sold 5,000 Inventory 5.000 (To record cost of merchandise sold) 112 Sales Returns and Allowances 350 Accounts Receivable 350 (To record merchandise returned) 112 Inventory 220 Cost of Goods Sold 220 (To record cost of merchandise returned) 9 Sales Discounts 152 Cash Account Receivable On June 10, Swifty Corporation purchased $7.950 of merchandise on account from Swifty Company, FOB shipping point, terms 2/10,n/30. Swifty Corporation pays the freight costs of $440 on June 11. Damaged goods totaling $350 are returned to Swifty for credit on June 12. The fair value of these goods is $80. On June 19, Swifty Corporation pays Swifty Company in full, less the purchase discount. Both companies use a perpetual inventory system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts