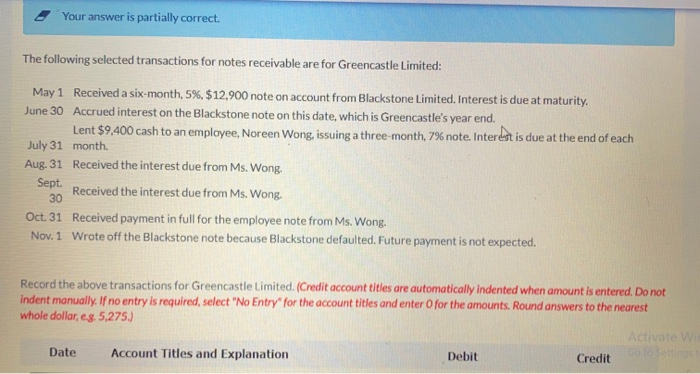

Question: Your answer is partially correct. The following selected transactions for notes receivable are for Greencastle Limited: May 1 Received a six-month, 5%, $12,900 note on

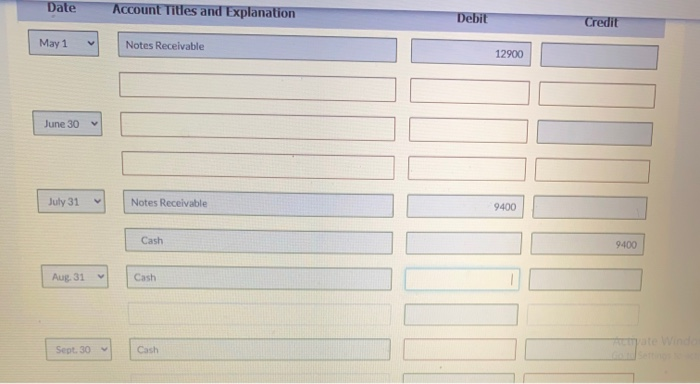

Your answer is partially correct. The following selected transactions for notes receivable are for Greencastle Limited: May 1 Received a six-month, 5%, $12,900 note on account from Blackstone Limited. Interest is due at maturity. June 30 Accrued interest on the Blackstone note on this date, which is Greencastle's year end. Lent $9,400 cash to an employee, Noreen Wong, issuing a three-month, 7% note. Interest is due at the end of each July 31 month Aug. 31 Received the interest due from Ms. Wong. Sept. Received the interest due from Ms. Wong. 30 Oct. 31 Received payment in full for the employee note from Ms. Wong, Nov. 1 Wrate off the Blackstone note because Blackstone defaulted. Future payment is not expected. Record the above transactions for Greencastle Limited. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter for the amounts. Round answers to the nearest whole dollar, es. 5,275.) Activate We Date Account Titles and Explanation Debit Credit Date Account Titles and Explanation Debit Credit May 1 Notes Receivable 12900 June 30 C July 31 Notes Receivable 9400 Cash 9400 Aug. 31 Cash Sept. 30 Cash Sept. 30 Cash Oct. 31 Cash Notes Receivable 9400 Nov. 1

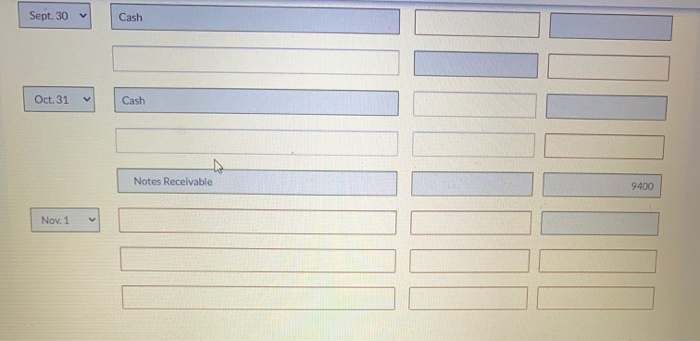

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts