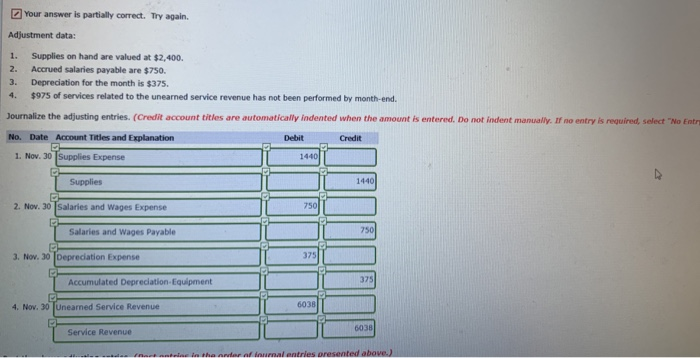

Question: your answer is partially correct. Try again. Adjustment data: 1. Supplies on hand are valued at $2,400. 2. Accrued salaries payable are $750. 3. Depreciation

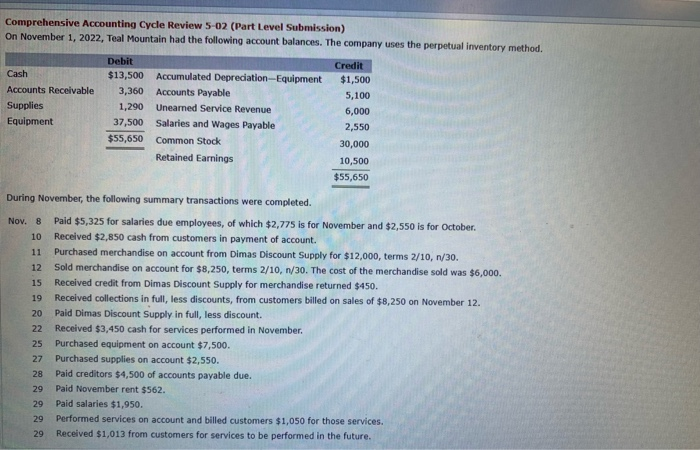

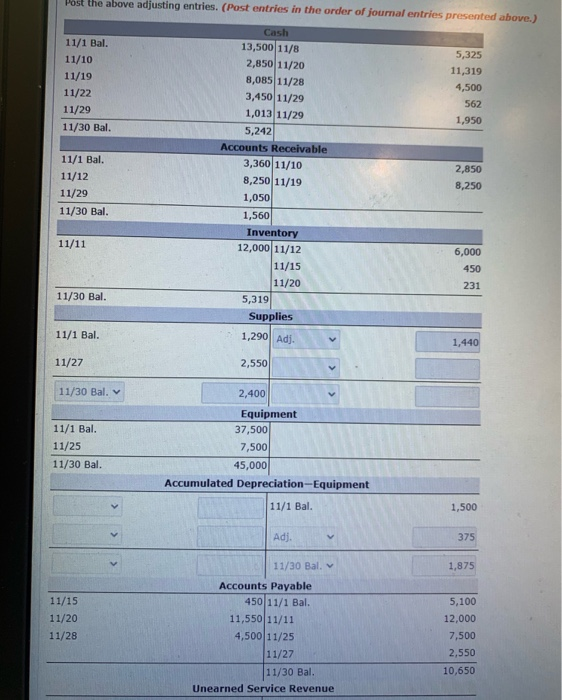

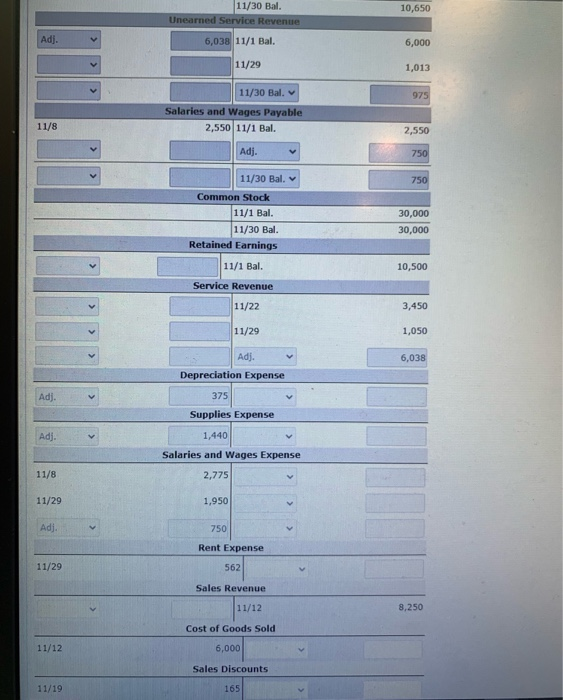

your answer is partially correct. Try again. Adjustment data: 1. Supplies on hand are valued at $2,400. 2. Accrued salaries payable are $750. 3. Depreciation for the month is $375. $975 of services related to the unearned service revenue has not been performed by month-end. Journalize the adjusting entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry No. Date Account Titles and Explanation Debit Credit 1. Nov. 30 Supplies Expense 14401 Supplies 1440 2. Nov. 30 salaries and Wages Expense 750 Salaries and Wages Payable 750 3. Nov. 30 Depreciation Expense 375 375 Accumulated Depreciation Equipment 4. Nov. 30 Unearned Service Revenue 6038 6038 Service Revenue the onlar ainmal entries oresented above.) Prepare an adjusted trial balance at November 30. TEAL MOUNTAIN Adjusted Trial Balance Debit Credit Totals Comprehensive Accounting Cycle Review 5-02 (Part Level Submission) On November 1, 2022, Teal Mountain had the following account balances. The company uses the perpetual inventory method. Cash Accounts Receivable Supplies Equipment Debit $13,500 Accumulated Depreciation Equipment 3,360 Accounts Payable 1,290 Unearned Service Revenue 37,500 Salaries and Wages Payable $55,650 Common Stock Retained Earnings Credit $1,500 5,100 6,000 2,550 30,000 10,500 $55,650 During November, the following summary transactions were completed. Nov. 8 10 11 12 15 19 20 22 25 27 28 29 Paid $5,325 for salaries due employees, of which $2,775 is for November and $2,550 is for October Received $2,850 cash from customers in payment of account. Purchased merchandise on account from Dimas Discount Supply for $12,000, terms 2/10, n/30. Sold merchandise on account for $8,250, terms 2/10, n/30. The cost of the merchandise sold was $6,000. Received credit from Dimas Discount Supply for merchandise returned $450. Received collections in full, less discounts, from customers billed on sales of $8,250 on November 12. Paid Dimas Discount Supply in full, less discount Received $3,450 cash for services performed in November Purchased equipment on account $7,500. Purchased supplies on account $2,550. Paid creditors $4,500 of accounts payable due. Paid November rent $562. Paid salaries $1,950. Performed services on account and billed customers $1,050 for those services. Received $1,013 from customers for services to be performed in the future. 29 29 29 Post the above adjusting entries. (Post entries in the order of journal entries presented above.) 11/1 Bal. 11/10 11/19 11/22 11/29 11/30 Bal. 5,325 11,319 4,500 562 1,950 11/1 Bal. 11/12 11/29 11/30 Bal. Cash 13,500 11/8 2,850 11/20 8,085 11/28 3,450 11/29 1,013 11/29 5,242 Accounts Receivable 3,360 11/10 8,250 11/19 1,050 1,560 Inventory 12,000 11/12 11/15 11/20 5,319 Supplies 2,850 8,250 11/11 6,000 450 231 11/30 Bal. 11/1 Bal. 1,290 Adj. 1,440 11/27 2,550 11/30 Bal. 2,400 11/1 Bal. 11/25 11/30 Bal. Equipment 37,500 7,500 45,000 Accumulated Depreciation-Equipment 11/1 Bal. 1,500 Adj. 375 11/30 Bal. 1,875 11/15 11/20 11/28 Accounts Payable 450 11/1 Bal. 11,550 11/11 4,500 11/25 11/27 11/30 Bal. Unearned Service Revenue 5,100 12,000 7,500 2,550 10,650

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts