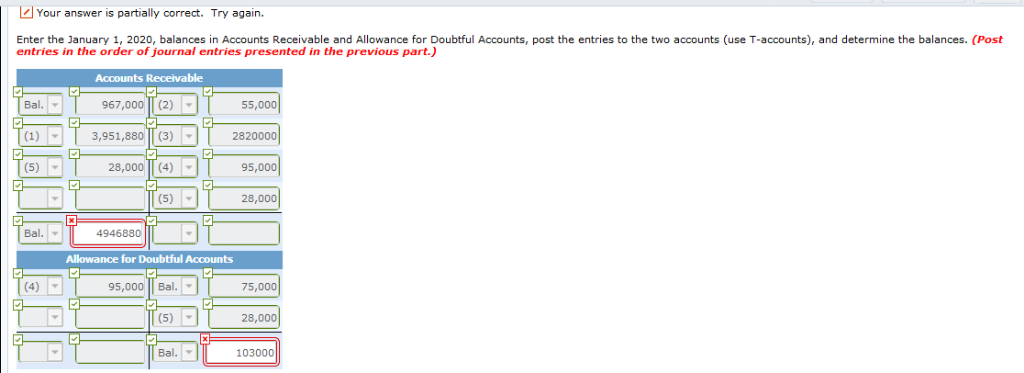

Question: Your answer is partially correct. Try again. Enter the January 1, 2020, balances in Accounts Receivable and Allowance for Doubtful Accounts, post the entries to

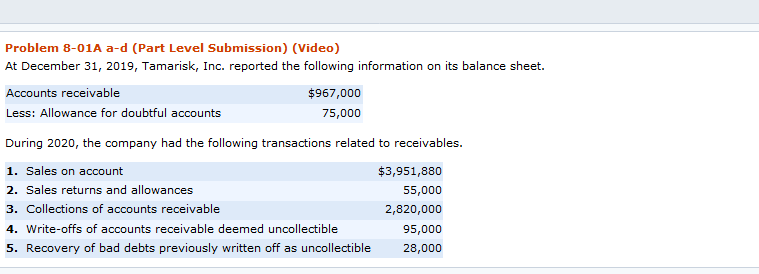

Your answer is partially correct. Try again. Enter the January 1, 2020, balances in Accounts Receivable and Allowance for Doubtful Accounts, post the entries to the two accounts (use T-accounts), and determine the balances. (Post entries in the order of journal entries presented in the previous part) Accounts Receivable 967,000 (2) 3,951,88011 (3) | 28,000 (4) Bal. 55,000 2820000 (5) 95,000 28,000 Bal. | 4946880 Allowance for Doubtful Accounts 95,00011 Bal. 28,000 Bal. | 103000 Problem 8-01A a-d (Part Level Submission) (Video) At December 31, 2019, Tamarisk, Inc. reported the following information on its balance sheet. Accounts receivable Less: Allowance for doubtful accounts $967,000 75,000 During 2020, the company had the following transactions related to receivables. 1. Sales on account 2. Sales returns and allowances 3. Collections of accounts receivable 4. Write-offs of accounts receivable deemed uncollectible 5. Recovery of bad debts previously written off as uncollectible 28,000 $3,951,880 55,000 2,820,000 95,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts