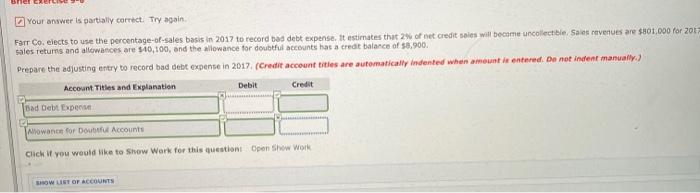

Question: Your answer is partially correct. Try again. Farr Co. elects to use the percentage-of-sales basis in 2017 to record bad debt expense. It estimates that

Your answer is partially correct. Try again. Farr Co. elects to use the percentage-of-sales basis in 2017 to record bad debt expense. It estimates that 2% of net credit sales will become uncollectible. Sales revenues are $801,000 for 2017 sales returns and allowances are $40,100, and the allowance for doubtful accounts has a credit balance of $8,900. Prepare the adjusting entry to record bad debt expense in 2017. (Credit account titles are automatically indented when amount is entered. De not indent manually.) Account Titles and Explanation Debit Credit Bad Debt Expense Allowance for Doubtful Accounts Click if you would like to Show Work for this question: Open Show Work SHOW LIST OF ACCOUNTS

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts