Question: Your answer is partially correct. Try again. heridan Company purchased land, a building, and equipment on January 2, 2017, for $880,000. The company paid $180,000

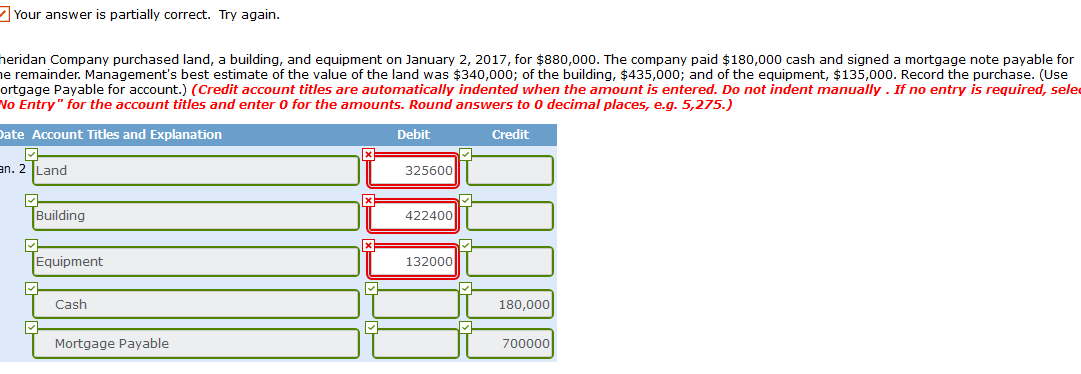

Your answer is partially correct. Try again. heridan Company purchased land, a building, and equipment on January 2, 2017, for $880,000. The company paid $180,000 cash and signed a mortgage note payable for he remainder. Management's best estimate of the value of the land was $340,000; of the building, $435,000; and of the equipment, $135,000. Record the purchase. (Use ortgage Payable for account.) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, sele No Entry" for the account titles and enter o for the amounts. Round answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit an. 2 Land 325600 Building 422400 Equipment 132000 Cash 180,000 Mortgage Payable 700000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts