Question: Your answer is partially correct. Try again. Pronghorn Inc. incurred a net operating loss of $522,000 in 2020. The tax rate for all years is

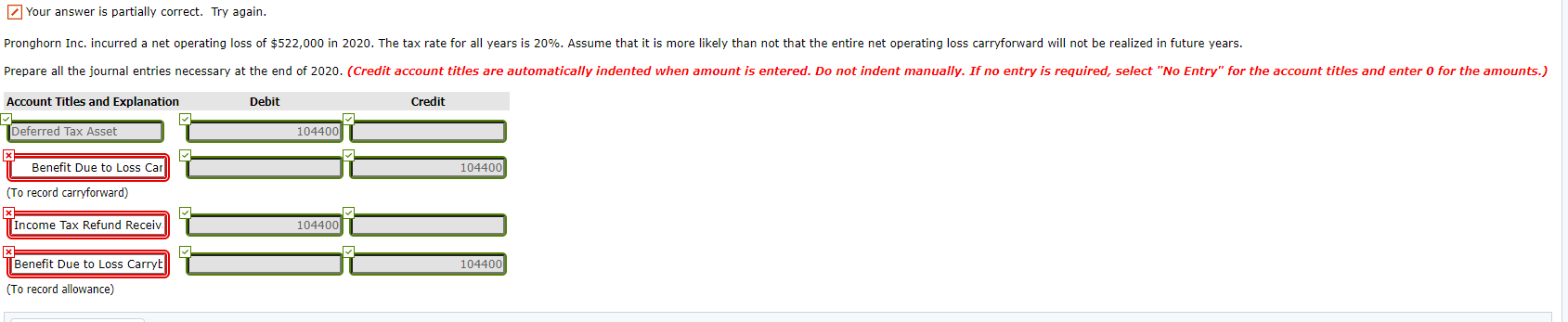

Your answer is partially correct. Try again. Pronghorn Inc. incurred a net operating loss of $522,000 in 2020. The tax rate for all years is 20%. Assume that it is more likely than not that the entire net operating loss carryforward will not be realized in future years. Prepare all the journal entries necessary at the end of 2020. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit Deferred Tax Asset 104400 x Benefit Due to Loss Car 104400 (To record carryforward) X Income Tax Refund Receiv 104400 x Benefit Due to Loss Carryt 104400 (To record allowance)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts