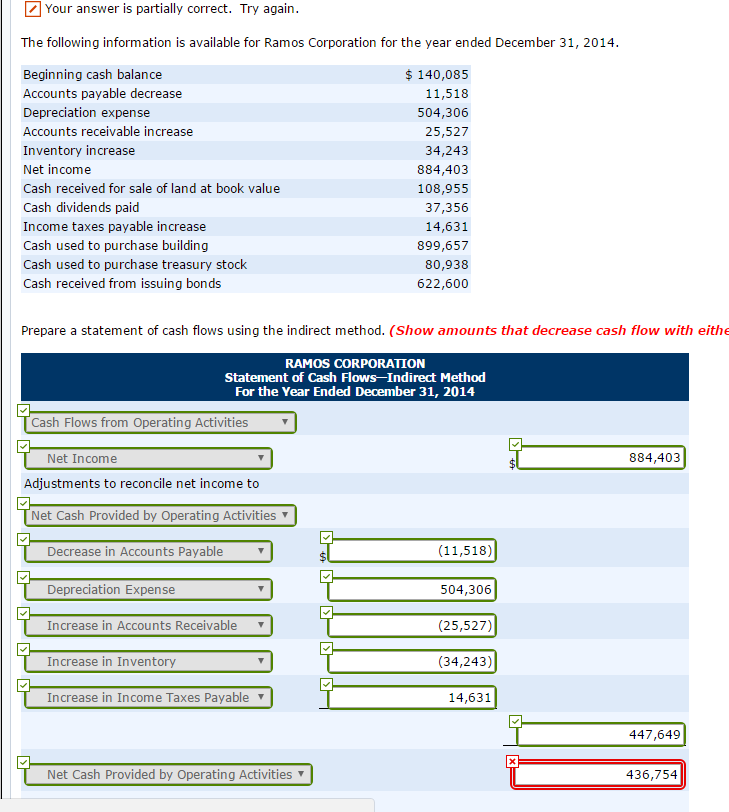

Question: Your answer is partially correct. Try again. The following information is available for Ramos Corporation for the year ended December 31, 2014. 140,085 Beginning cash

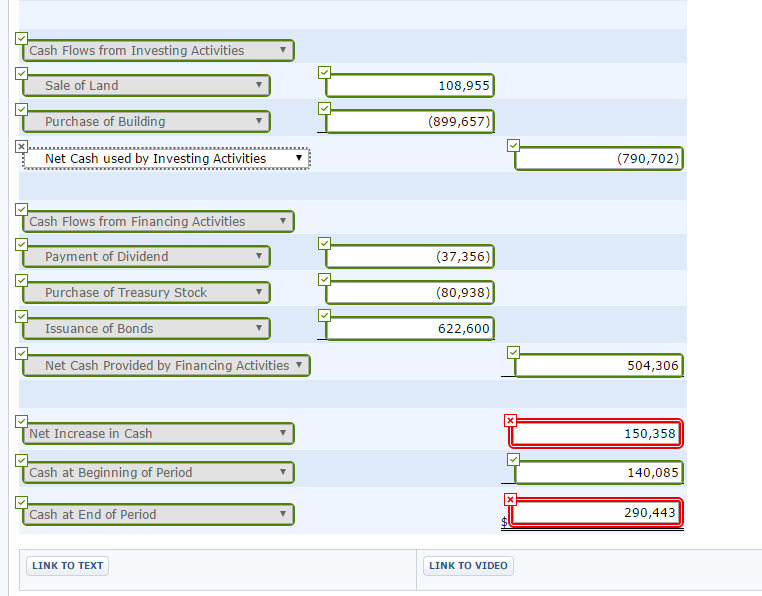

Your answer is partially correct. Try again. The following information is available for Ramos Corporation for the year ended December 31, 2014. 140,085 Beginning cash balance Accounts payable decrease 11,518 Depreciation expense 504,306 Accounts receivable increase 25,527 Inventory increase 34,243 Net income 884,403 Cash received for sale of land at book value 108,955 Cash dividends paid 37,356 Income taxes payable increase 14,631 Cash used to purchase building 899,657 Cash used to purchase treasury stock 80,938 Cash received from issuing bonds 622,600 Prepare a statement of cash flows using the indirect method. (Show amounts that decrease cash flow with eithe RAMOS CORPORATION Statement of Cash Flows Indirect Method For the Year Ended December 31, 2014 Cash Flows from Operating Activities 884,403 Net Income Adjustments to reconcile net income to Net Cash Provided by Operating Activities (11,518) Decrease in Accounts Payable Depreciation Expense 504,306 Increase in Accounts Receivable (25,527) Increase in Inventory (34,243) Increase in Income Taxes Payable 14,631 447,649 Net Cash Provided by Operating Activities 436,754

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts