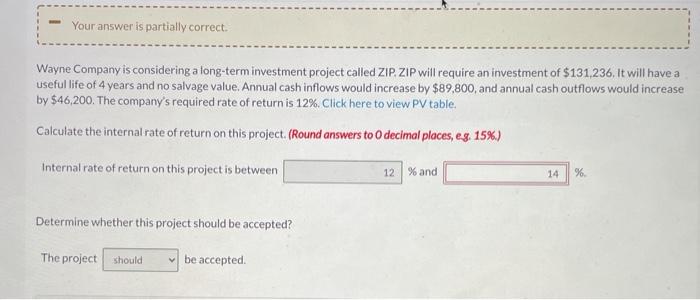

Question: Your answer is partially correct. Wayne Company is considering a long-term investment project called ZIP, ZIP will require an investment of $131,236. It will have

Your answer is partially correct. Wayne Company is considering a long-term investment project called ZIP, ZIP will require an investment of $131,236. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $89,800, and annual cash outflows would increase by $46,200. The company's required rate of return is 12%. Click here to view PV table. Calculate the internal rate of return on this project. (Round answers to decimal places, eg. 15%) Internal rate of return on this project is between 12% and 14 % Determine whether this project should be accepted? The project should be accepted Your answer is partially correct. Wayne Company is considering a long-term investment project called ZIP, ZIP will require an investment of $131,236. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $89,800, and annual cash outflows would increase by $46,200. The company's required rate of return is 12%. Click here to view PV table. Calculate the internal rate of return on this project. (Round answers to decimal places, eg. 15%) Internal rate of return on this project is between 12% and 14 % Determine whether this project should be accepted? The project should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts