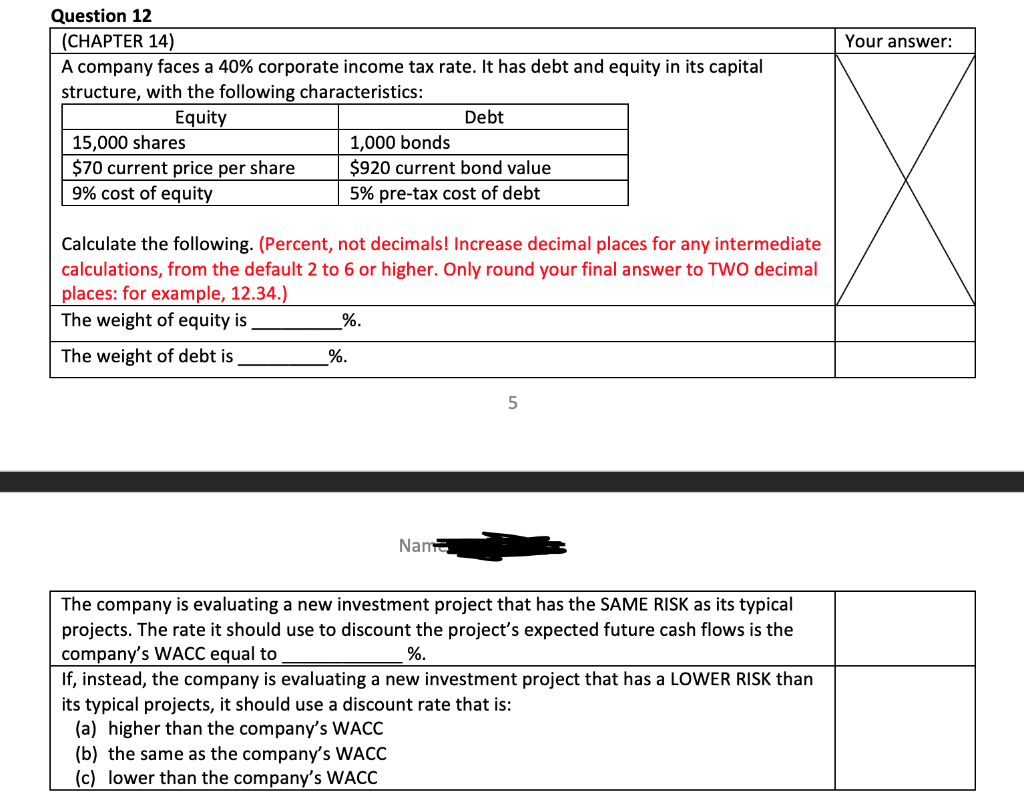

Question: Your answer: Question 12 (CHAPTER 14) A company faces a 40% corporate income tax rate. It has debt and equity in its capital structure, with

Your answer: Question 12 (CHAPTER 14) A company faces a 40% corporate income tax rate. It has debt and equity in its capital structure, with the following characteristics: Equity Debt 15,000 shares 1,000 bonds $70 current price per share $920 current bond value 9% cost of equity 5% pre-tax cost of debt Calculate the following. (Percent, not decimals! Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer to TWO decimal places: for example, 12.34.) The weight of equity is _%. The weight of debt is_ _%. Nania The company is evaluating a new investment project that has the SAME RISK as its typical projects. The rate it should use to discount the project's expected future cash flows is the company's WACC equal to If, instead, the company is evaluating a new investment project that has a LOWER RISK than its typical projects, it should use a discount rate that is: (a) higher than the company's WACC (b) the same as the company's WACC (c) lower than the company's WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts