Question: Your answer: Question 6 (CHAPTER 7) A corporation has just issued 9% coupon bonds with $1,000 face value. These bonds will mature in 16 years,

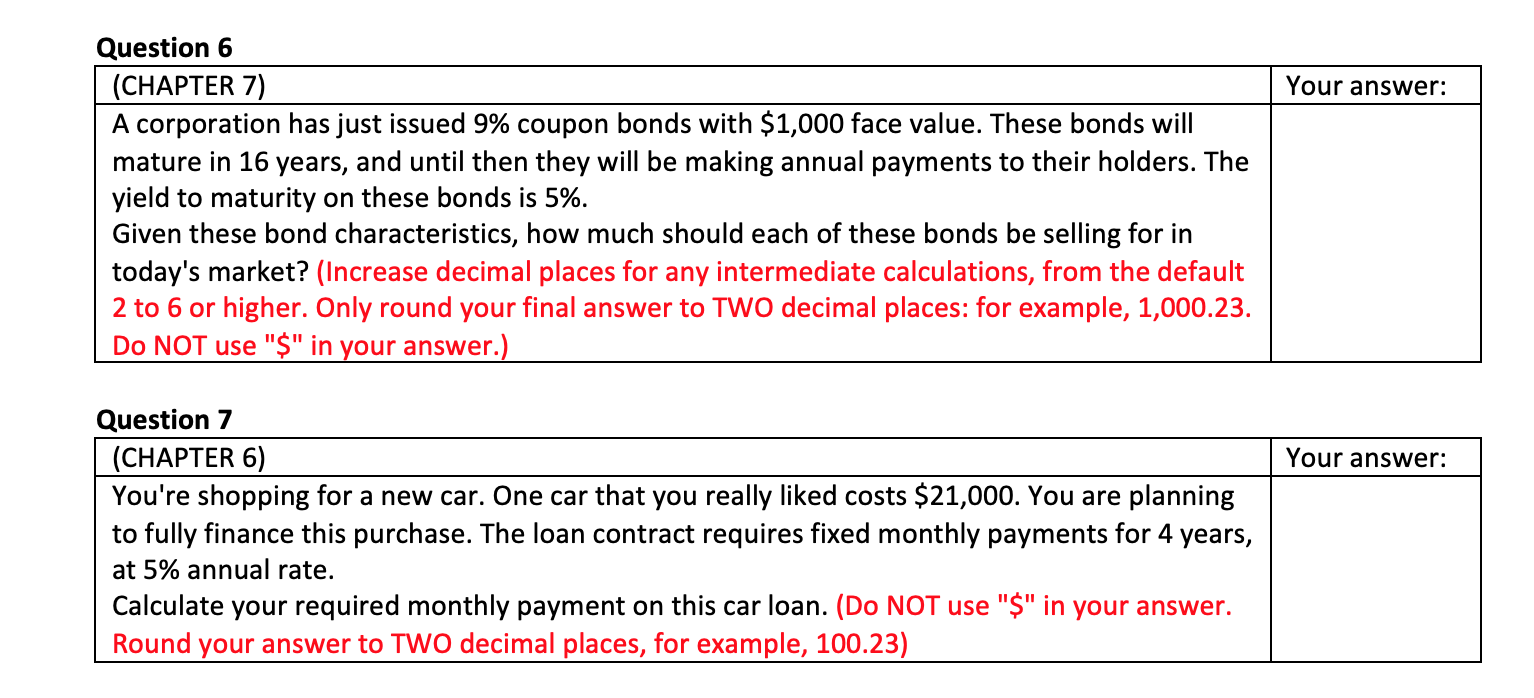

Your answer: Question 6 (CHAPTER 7) A corporation has just issued 9% coupon bonds with $1,000 face value. These bonds will mature in 16 years, and until then they will be making annual payments to their holders. The yield to maturity on these bonds is 5%. Given these bond characteristics, how much should each of these bonds be selling for in today's market? (Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer to TWO decimal places: for example, 1,000.23. Do NOT use "$" in your answer.) Your answer: Question 7 (CHAPTER 6) You're shopping for a new car. One car that you really liked costs $21,000. You are planning to fully finance this purchase. The loan contract requires fixed monthly payments for 4 years, at 5% annual rate. Calculate your required monthly payment on this car loan. (Do NOT use "$" in your answer. Round your answer to TWO decimal places, for example, 100.23)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts