Question: Your answer: Question 8 (CHAPTER 9) Department manager is ready to invest money into an investment project that pays back within 2 years. The table

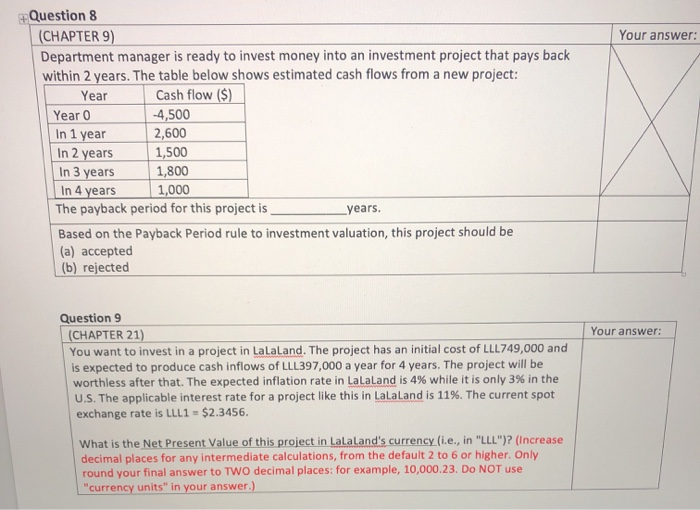

Your answer: Question 8 (CHAPTER 9) Department manager is ready to invest money into an investment project that pays back within 2 years. The table below shows estimated cash flows from a new project: Year Cash flow ($) Year 0 -4,500 In 1 year 2,600 In 2 years 1,500 In 3 years 1,800 In 4 years 1,000 The payback period for this project is years. Based on the Payback Period rule to investment valuation, this project should be (a) accepted (b) rejected Your answer: Question 9 (CHAPTER 21) You want to invest in a project in Lalaland. The project has an initial cost of LLL749,000 and is expected to produce cash inflows of LLL397,000 a year for 4 years. The project will be worthless after that. The expected inflation rate in LaLaLand is 4% while it is only 3% in the U.S. The applicable interest rate for a project like this in Lalaland is 11%. The current spot exchange rate is LLL1 - $2.3456 What is the Net Present Value of this project in Lalaland's currency (i.e., in "LLL")? (Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer to TWO decimal places: for example, 10,000.23. Do NOT use "currency units" in your answer.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts