Question: Your answers are saved automatically Remaining Time: 2 hours, 09 minutes, 12 seconds. Question Completion Status: 36 2 37 7 38 5 40 8 1

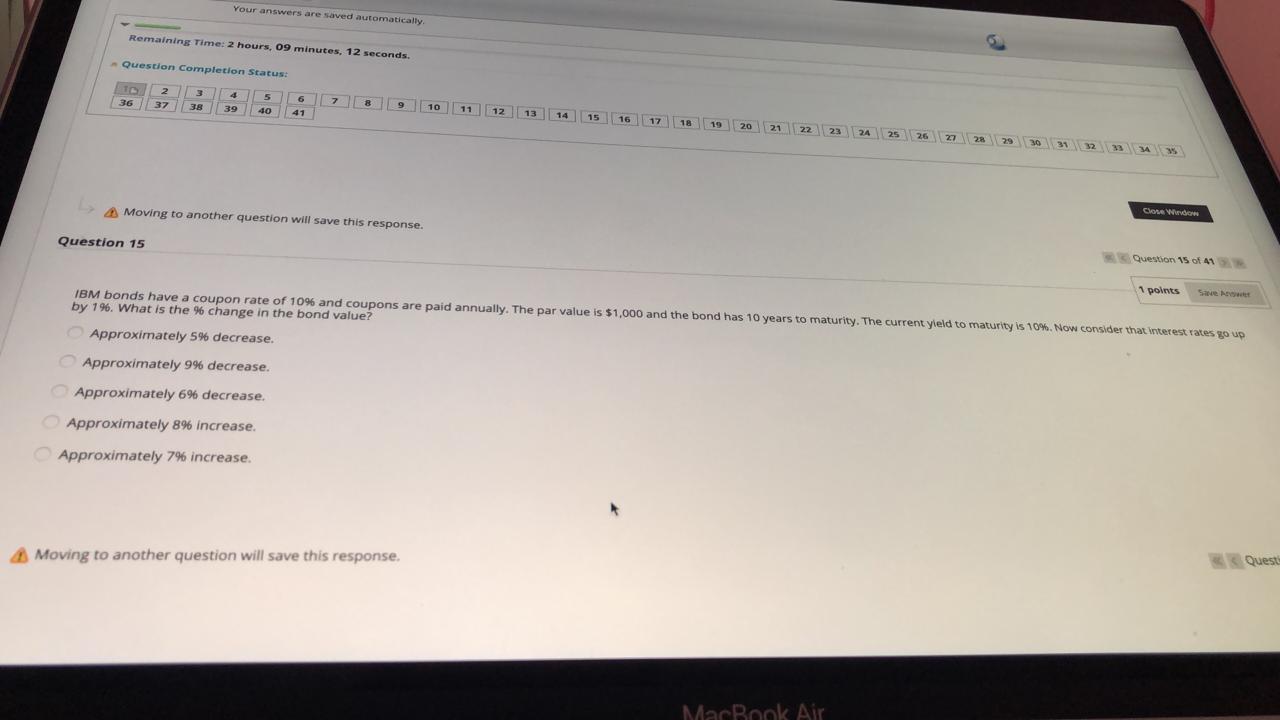

Your answers are saved automatically Remaining Time: 2 hours, 09 minutes, 12 seconds. Question Completion Status: 36 2 37 7 38 5 40 8 1 9 10 11 39 41 12 13 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 Moving to another question will save this response. Con Wed Question 15 Question 15 of 41 1 points IBM bonds have a coupon rate of 10% and coupons are paid annually. The par value is $1,000 and the bond has 10 years to maturity. The current yield to maturity is 10%. Now consider that interest rates go up by 196. What is the % change in the bond value Approximately 5% decrease. Approximately 9% decrease. Approximately 6% decrease. Approximately 8% increase. Approximately 7% increase. Moving to another question will save this response. Questo MacBook Air

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts