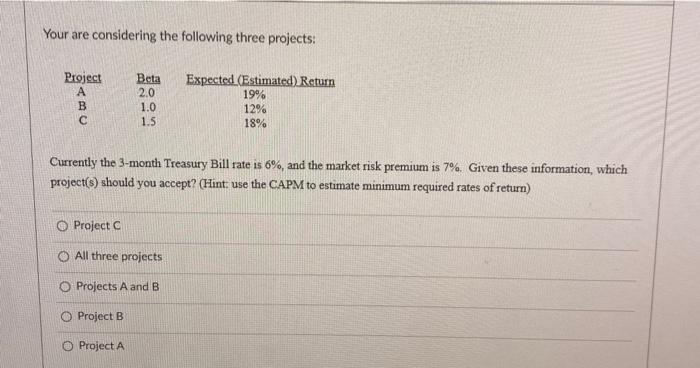

Question: Your are considering the following three projects: Project Beta 2.0 1.0 1.5 Expected.(Estimated) Return 19% 12% 18% B Currently the 3-month Treasury Bill rate is

Your are considering the following three projects: Project Beta 2.0 1.0 1.5 Expected.(Estimated) Return 19% 12% 18% B Currently the 3-month Treasury Bill rate is 6%, and the market risk premium is 7%. Given these information, which project(s) should you accept? (Hint: use the CAPM to estimate minimum required rates of return) Project O All three projects O Projects A and B O Project B Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts