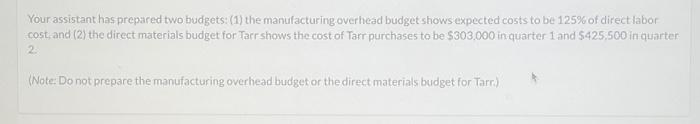

Question: Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost and (2) the direct

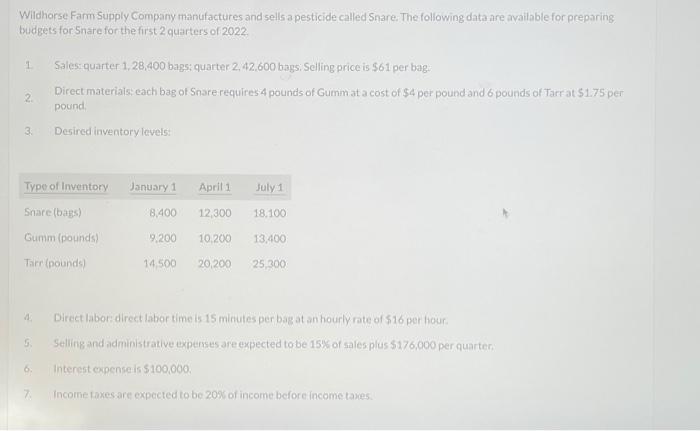

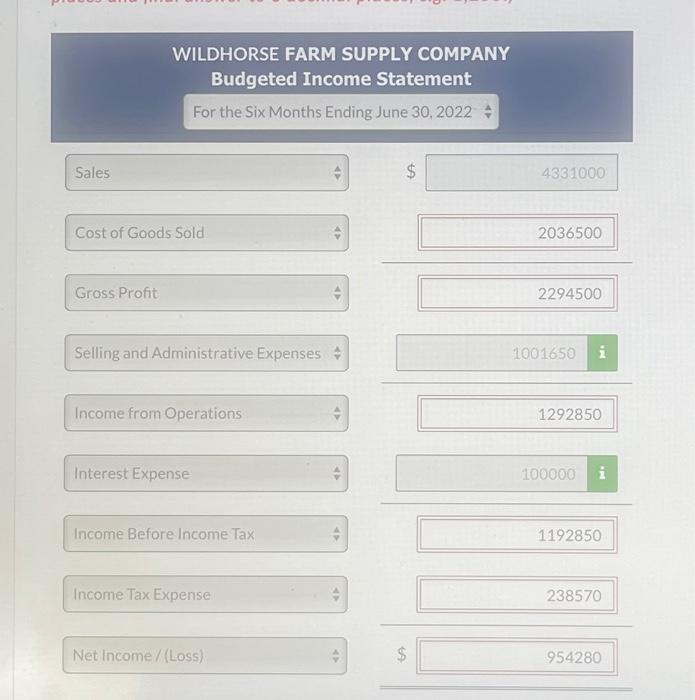

Your assistant has prepared two budgets: (1) the manufacturing overhead budget shows expected costs to be 125% of direct labor cost and (2) the direct materials hudget for Tarr chows the rost of Tarr nurchases to he $303000 incouartar 1 and $425.500 in auiart er 2. (Note: Do not prepare the manufacturing overhead budget or the direct materials budget for Tarr.) Wildhorse Farm Supply Company manufactures and sells a pesticide called Snare. The following data are available for preparing 1. Sales:quarter 1,28,400 bags; quarter 2,42,600 bags: Selling price is $61 per bag: pound. 3. Desired inventory levels: 4. Direct labon: direct labor time is 15 minutes per bag at an hourly rate of $16 per hour: 6. hteresterpenteis $100000. 7. Income taxes are expected to be 20x of income before income taves. WILDHORSE FARM SUPPLY COMPANY Budgeted Income Statement For the Six Months Ending June 30, 2022 - Sales Cost of Goods Sold Gross Profit Selling and Administrative Expenses v^ Income from Operations Interest Expense Income Before Income Tax Income Tax Expense Net Income / (Loss) $ $ 954280

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts