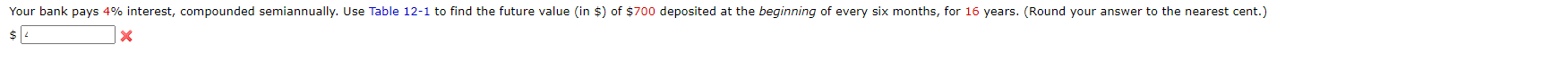

Question: Your bank pays 4% interest, compounded semiannually. Use Table 12-1 to find the future value in $) of $700 deposited at the beginning of every

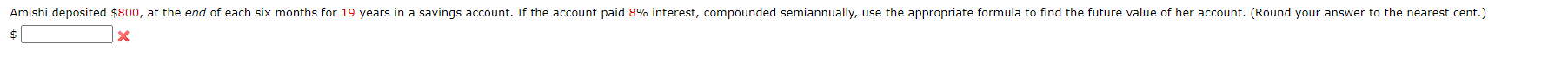

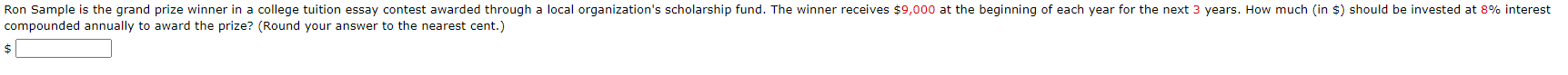

Your bank pays 4% interest, compounded semiannually. Use Table 12-1 to find the future value in $) of $700 deposited at the beginning of every six months, for 16 years. (Round your answer to the nearest cent.) X Amishi deposited $800, at the end of each six months for 19 years in a savings account. If the account paid 8% interest, compounded semiannually, use the appropriate formula to find the future value of her account. (Round your answer to the nearest cent.) X Ron Sample is the grand prize winner in a college tuition essay contest awarded through a local organization's scholarship fund. The winner receives $9,000 at the beginning of each year for the next 3 years. How much in $) should be invested at 8% interest compounded annually to award the prize? (Round your answer to the nearest cent.) $ Jennifer Kaufman bought a used Toyota Prius for $16,500. She made a $3,500 down payment and is financing the balance at a particular bank over a 3 year period at 12% interest. As her banker, calculate what equal monthly payments (in %) will be required by Jennifer to amortize the car loan. (Round your answer to the nearest cent.) x Use the appropriate formula to find the amortization payment in $) you would need to make each month, at 12% interest compounded monthly, to pay off a loan of $8,500 in 3 years. (Round your answer to the nearest cent.) $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts