Question: Your boss hands you the following information about two mutually exclusive projects. She adds the following Our discount rate is 10% and both proje project

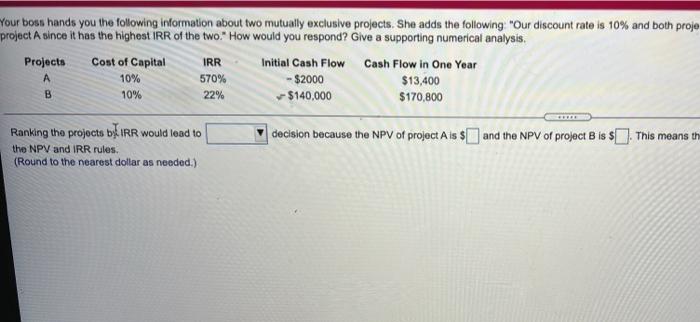

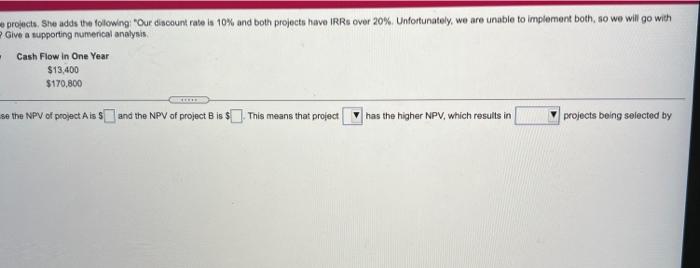

Your boss hands you the following information about two mutually exclusive projects. She adds the following "Our discount rate is 10% and both proje project A since it has the highest IRR of the two." How would you respond? Give a supporting numerical analysis. Projects Cost of Capital IRR Initial Cash Flow Cash Flow in One Year 10% 570% - $2000 $13,400 B 10% 22% - $140,000 $170,800 SERE decision because the NPV of project Als $ and the NPV of project Bis This means th Ranking the projects but IRR would lead to the NPV and IRR rules (Round to the nearest dollar as needed.) proncts. She adds the following "Our discount rate la 10% and both projects have IRR over 20% Unfortunately, we are unable to implement both, so we will go with Give a supporting numerical analysis . Cash Flow in One Year $13,400 $170,800 BE se the NPV of project Ais S and the NPV of project is $ This means that project has the higher NPV, which results in projects being selected by

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts