Question: Your boss has asked you to evaluate a capital restructuring proposal. Your company Mankayane Milling Limited (MML) is an all-equity financed firm with expected perpetual

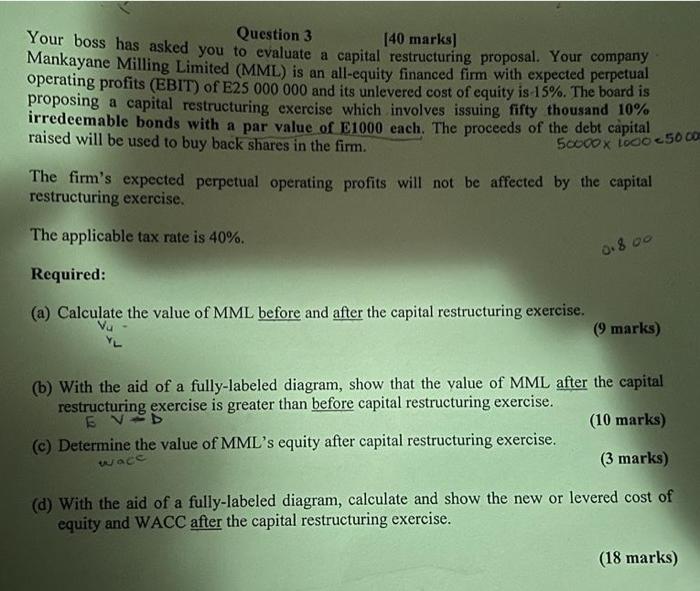

Question 3 [40 marks] Your boss has asked you to evaluate a capital restructuring proposal. Your company Mankayane Milling Limited (MML) is an all-equity financed firm with expected perpetual operating profits (EBIT) of E25 000000 and its unlevered cost of equity is 15%. The board is proposing a capital restructuring exercise which involves issuing fifty thousand 10% irredeemable bonds with a par value of E1000 each. The proceeds of the debt capital raised will be used to buy back shares in the firm. 500001000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts